Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the fourth quarter, many investors lost money due to unpredictable events such as the sudden increase in long-term interest rates and unintended consequences of the trade war with China. Nevertheless, many of the stocks that tanked in the fourth quarter still sport strong fundamentals and their decline was more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Chesapeake Energy Corporation (NYSE:CHK) changed recently.

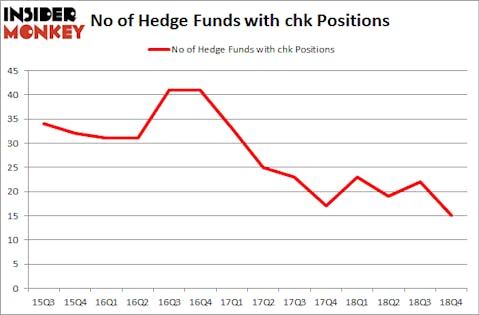

Is Chesapeake Energy Corporation (NYSE:CHK) a cheap stock to buy now? The best stock pickers are becoming less hopeful. The number of bullish hedge fund positions dropped by 7 recently. Our calculations also showed that chk isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are numerous formulas stock traders can use to evaluate publicly traded companies. A duo of the less utilized formulas are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the elite fund managers can beat the broader indices by a very impressive amount (see the details here).

Let’s take a look at the fresh hedge fund action regarding Chesapeake Energy Corporation (NYSE:CHK).

What does the smart money think about Chesapeake Energy Corporation (NYSE:CHK)?

At the end of the fourth quarter, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -32% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CHK over the last 14 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Among these funds, Millennium Management held the most valuable stake in Chesapeake Energy Corporation (NYSE:CHK), which was worth $21.9 million at the end of the third quarter. On the second spot was Huber Capital Management which amassed $17.6 million worth of shares. Moreover, AQR Capital Management, Renaissance Technologies, and Citadel Investment Group were also bullish on Chesapeake Energy Corporation (NYSE:CHK), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Chesapeake Energy Corporation (NYSE:CHK) has faced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there is a sect of fund managers that decided to sell off their positions entirely by the end of the third quarter. Intriguingly, Michael Kao’s Akanthos Capital cut the biggest stake of the “upper crust” of funds monitored by Insider Monkey, valued at close to $5.6 million in stock. John Horseman’s fund, Horseman Capital Management, also dumped its stock, about $3.8 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 7 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Chesapeake Energy Corporation (NYSE:CHK). These stocks are NxStage Medical, Inc. (NASDAQ:NXTM), Trustmark Corp (NASDAQ:TRMK), B&G Foods, Inc. (NYSE:BGS), and Banner Corporation (NASDAQ:BANR). This group of stocks’ market valuations resemble CHK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NXTM | 28 | 569758 | -4 |

| TRMK | 10 | 13053 | -1 |

| BGS | 10 | 127033 | -3 |

| BANR | 18 | 85482 | -2 |

| Average | 16.5 | 198832 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $199 million. That figure was $75 million in CHK’s case. NxStage Medical, Inc. (NASDAQ:NXTM) is the most popular stock in this table. On the other hand Trustmark Corp (NASDAQ:TRMK) is the least popular one with only 10 bullish hedge fund positions. Chesapeake Energy Corporation (NYSE:CHK) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on CHK as the stock returned 47.6% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.