Is Canadian Pacific Railway Limited (NYSE:CP) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

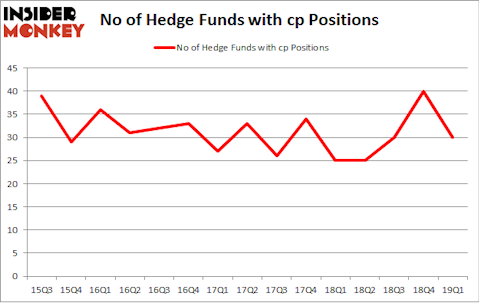

Canadian Pacific Railway Limited (NYSE:CP) has seen a decrease in support from the world’s most elite money managers lately. CP was in 30 hedge funds’ portfolios at the end of March. There were 40 hedge funds in our database with CP holdings at the end of the previous quarter. Our calculations also showed that cp isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to check out the fresh hedge fund action encompassing Canadian Pacific Railway Limited (NYSE:CP).

Hedge fund activity in Canadian Pacific Railway Limited (NYSE:CP)

At Q1’s end, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CP over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Egerton Capital Limited was the largest shareholder of Canadian Pacific Railway Limited (NYSE:CP), with a stake worth $699.6 million reported as of the end of March. Trailing Egerton Capital Limited was Lone Pine Capital, which amassed a stake valued at $663.3 million. Arrowstreet Capital, Renaissance Technologies, and Holocene Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Because Canadian Pacific Railway Limited (NYSE:CP) has experienced declining sentiment from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of funds that elected to cut their entire stakes by the end of the third quarter. At the top of the heap, Andreas Halvorsen’s Viking Global cut the largest investment of the 700 funds monitored by Insider Monkey, valued at about $84.4 million in call options. Joseph Samuels’s fund, Islet Management, also cut its call options, about $71 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 10 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Canadian Pacific Railway Limited (NYSE:CP). These stocks are Paychex, Inc. (NASDAQ:PAYX), ONEOK, Inc. (NYSE:OKE), Baker Hughes, a GE company (NYSE:BHGE), and Southwest Airlines Co. (NYSE:LUV). All of these stocks’ market caps match CP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAYX | 21 | 808401 | -9 |

| OKE | 14 | 278924 | -12 |

| BHGE | 23 | 415986 | -5 |

| LUV | 35 | 3383550 | -5 |

| Average | 23.25 | 1221715 | -7.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $1222 million. That figure was $1975 million in CP’s case. Southwest Airlines Co. (NYSE:LUV) is the most popular stock in this table. On the other hand ONEOK, Inc. (NYSE:OKE) is the least popular one with only 14 bullish hedge fund positions. Canadian Pacific Railway Limited (NYSE:CP) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CP as the stock returned 7.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.