Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

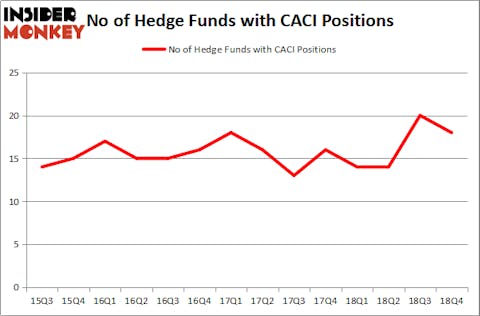

CACI International Inc (NYSE:CACI) was in 18 hedge funds’ portfolios at the end of the fourth quarter of 2018. CACI investors should pay attention to a decrease in hedge fund sentiment of late. There were 20 hedge funds in our database with CACI positions at the end of the previous quarter. Our calculations also showed that CACI isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are perceived as worthless, outdated financial vehicles of yesteryear. While there are over 8000 funds in operation at the moment, We hone in on the upper echelon of this group, approximately 750 funds. These hedge fund managers handle the majority of the smart money’s total capital, and by keeping an eye on their unrivaled investments, Insider Monkey has revealed several investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s review the recent hedge fund action regarding CACI International Inc (NYSE:CACI).

Hedge fund activity in CACI International Inc (NYSE:CACI)

At the end of the fourth quarter, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -10% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CACI over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Adage Capital Management held the most valuable stake in CACI International Inc (NYSE:CACI), which was worth $40 million at the end of the third quarter. On the second spot was Horizon Asset Management which amassed $37 million worth of shares. Moreover, Renaissance Technologies, GLG Partners, and Millennium Management were also bullish on CACI International Inc (NYSE:CACI), allocating a large percentage of their portfolios to this stock.

Seeing as CACI International Inc (NYSE:CACI) has witnessed bearish sentiment from the aggregate hedge fund industry, we can see that there was a specific group of money managers that slashed their positions entirely in the third quarter. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP dropped the biggest stake of all the hedgies followed by Insider Monkey, totaling about $5.8 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund dumped about $4.2 million worth. These moves are important to note, as total hedge fund interest fell by 2 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to CACI International Inc (NYSE:CACI). These stocks are Urban Outfitters, Inc. (NASDAQ:URBN), IBERIABANK Corporation (NASDAQ:IBKC), Healthcare Realty Trust Inc (NYSE:HR), and Ritchie Bros. Auctioneers Incorporated (NYSE:RBA). This group of stocks’ market valuations match CACI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| URBN | 28 | 370543 | -3 |

| IBKC | 24 | 224156 | 3 |

| HR | 9 | 43650 | 5 |

| RBA | 12 | 90035 | -3 |

| Average | 18.25 | 182096 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $182 million. That figure was $123 million in CACI’s case. Urban Outfitters, Inc. (NASDAQ:URBN) is the most popular stock in this table. On the other hand Healthcare Realty Trust Inc (NYSE:HR) is the least popular one with only 9 bullish hedge fund positions. CACI International Inc (NYSE:CACI) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on CACI as the stock returned 30.2% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.