Is BMC Stock Holdings, Inc. (NASDAQ:BMCH) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

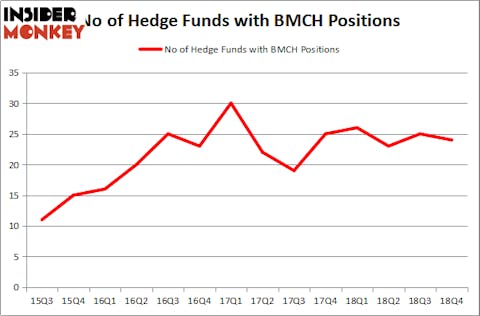

BMC Stock Holdings, Inc. (NASDAQ:BMCH) investors should be aware of a decrease in hedge fund interest of late. BMCH was in 24 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 25 hedge funds in our database with BMCH holdings at the end of the previous quarter. Our calculations also showed that BMCH isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to view the fresh hedge fund action surrounding BMC Stock Holdings, Inc. (NASDAQ:BMCH).

Hedge fund activity in BMC Stock Holdings, Inc. (NASDAQ:BMCH)

At Q4’s end, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from the previous quarter. On the other hand, there were a total of 26 hedge funds with a bullish position in BMCH a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Anthony Bozza’s Lakewood Capital Management has the number one position in BMC Stock Holdings, Inc. (NASDAQ:BMCH), worth close to $35.4 million, comprising 1.2% of its total 13F portfolio. Sitting at the No. 2 spot is Coliseum Capital, managed by Christopher Shackelton and Adam Gray, which holds a $31.2 million position; the fund has 11.6% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish consist of William C. Martin’s Raging Capital Management, Michael Price’s MFP Investors and Crispin Odey’s Odey Asset Management Group.

Because BMC Stock Holdings, Inc. (NASDAQ:BMCH) has experienced falling interest from the smart money, it’s safe to say that there was a specific group of hedgies that decided to sell off their positions entirely in the third quarter. Intriguingly, Paul Reeder and Edward Shapiro’s PAR Capital Management said goodbye to the biggest stake of all the hedgies followed by Insider Monkey, totaling about $6.4 million in stock. Martin Whitman’s fund, Third Avenue Management, also dumped its stock, about $5.5 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 1 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to BMC Stock Holdings, Inc. (NASDAQ:BMCH). These stocks are CareDx, Inc. (NASDAQ:CDNA), CNX Midstream Partners LP (NYSE:CNXM), Lindsay Corporation (NYSE:LNN), and Carrizo Oil & Gas, Inc. (NASDAQ:CRZO). This group of stocks’ market caps resemble BMCH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CDNA | 22 | 142197 | 3 |

| CNXM | 6 | 13468 | -3 |

| LNN | 11 | 214015 | 3 |

| CRZO | 13 | 65343 | -5 |

| Average | 13 | 108756 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $109 million. That figure was $192 million in BMCH’s case. CareDx, Inc. (NASDAQ:CDNA) is the most popular stock in this table. On the other hand CNX Midstream Partners LP (NYSE:CNXM) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks BMC Stock Holdings, Inc. (NASDAQ:BMCH) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on BMCH as the stock returned 28.2% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.