We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article we look at what those investors think of Aspen Technology, Inc. (NASDAQ:AZPN).

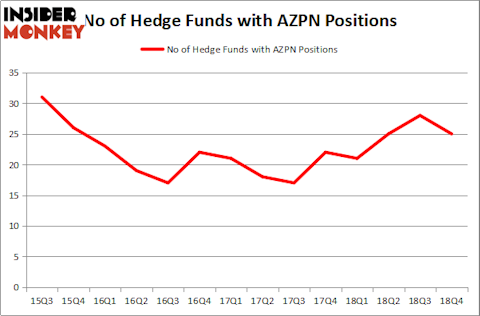

Aspen Technology, Inc. (NASDAQ:AZPN) was in 25 hedge funds’ portfolios at the end of December. AZPN has experienced a decrease in enthusiasm from smart money lately. There were 28 hedge funds in our database with AZPN positions at the end of the previous quarter. Our calculations also showed that AZPN isn’t among the 30 most popular stocks among hedge funds.

Today there are a lot of indicators investors have at their disposal to appraise their holdings. Some of the most useful indicators are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the best money managers can outpace the broader indices by a significant margin (see the details here).

We’re going to take a peek at the recent hedge fund action encompassing Aspen Technology, Inc. (NASDAQ:AZPN).

Hedge fund activity in Aspen Technology, Inc. (NASDAQ:AZPN)

At Q4’s end, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of -11% from the previous quarter. On the other hand, there were a total of 21 hedge funds with a bullish position in AZPN a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Aspen Technology, Inc. (NASDAQ:AZPN), which was worth $326.9 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $153.3 million worth of shares. Moreover, Two Creeks Capital Management, Citadel Investment Group, and Marshall Wace LLP were also bullish on Aspen Technology, Inc. (NASDAQ:AZPN), allocating a large percentage of their portfolios to this stock.

Seeing as Aspen Technology, Inc. (NASDAQ:AZPN) has experienced falling interest from the aggregate hedge fund industry, we can see that there is a sect of hedge funds who sold off their full holdings in the third quarter. Interestingly, Robert Joseph Caruso’s Select Equity Group dumped the largest stake of the 700 funds tracked by Insider Monkey, totaling an estimated $48 million in stock, and Scott Phillips’s Latimer Light Capital was right behind this move, as the fund cut about $26.1 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 3 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Aspen Technology, Inc. (NASDAQ:AZPN). These stocks are Columbia Sportswear Company (NASDAQ:COLM), Douglas Emmett, Inc. (NYSE:DEI), Jones Lang LaSalle Inc (NYSE:JLL), and The Middleby Corporation (NASDAQ:MIDD). This group of stocks’ market valuations resemble AZPN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COLM | 24 | 232254 | 1 |

| DEI | 12 | 327862 | -2 |

| JLL | 19 | 711575 | -2 |

| MIDD | 17 | 499841 | 0 |

| Average | 18 | 442883 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $443 million. That figure was $906 million in AZPN’s case. Columbia Sportswear Company (NASDAQ:COLM) is the most popular stock in this table. On the other hand Douglas Emmett, Inc. (NYSE:DEI) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Aspen Technology, Inc. (NASDAQ:AZPN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on AZPN as the stock returned 27.6% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.