Is Ascendis Pharma A/S (NASDAQ:ASND) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Is Ascendis Pharma A/S (NASDAQ:ASND) undervalued? Prominent investors are taking a pessimistic view. The number of long hedge fund positions were trimmed by 1 recently. Our calculations also showed that asnd isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a lot of gauges stock traders use to analyze their holdings. A pair of the most useful gauges are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can beat the market by a healthy amount (see the details here).

Let’s analyze the fresh hedge fund action regarding Ascendis Pharma A/S (NASDAQ:ASND).

What have hedge funds been doing with Ascendis Pharma A/S (NASDAQ:ASND)?

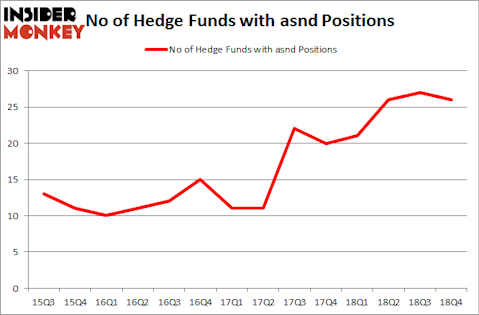

At the end of the fourth quarter, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from one quarter earlier. By comparison, 21 hedge funds held shares or bullish call options in ASND a year ago. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, RA Capital Management held the most valuable stake in Ascendis Pharma A/S (NASDAQ:ASND), which was worth $265.7 million at the end of the third quarter. On the second spot was OrbiMed Advisors which amassed $256.1 million worth of shares. Moreover, Baker Bros. Advisors, Vivo Capital, and venBio Select Advisor were also bullish on Ascendis Pharma A/S (NASDAQ:ASND), allocating a large percentage of their portfolios to this stock.

Since Ascendis Pharma A/S (NASDAQ:ASND) has experienced falling interest from the aggregate hedge fund industry, we can see that there lies a certain “tier” of fund managers that slashed their entire stakes by the end of the third quarter. At the top of the heap, Brian Ashford-Russell and Tim Woolley’s Polar Capital dropped the largest investment of the “upper crust” of funds tracked by Insider Monkey, totaling close to $3.5 million in stock. Jim Simons’s fund, Renaissance Technologies, also cut its stock, about $3 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Ascendis Pharma A/S (NASDAQ:ASND) but similarly valued. We will take a look at AllianceBernstein Holding LP (NYSE:AB), LiveRamp Holdings, Inc. (NYSE:RAMP), Kennedy-Wilson Holdings Inc (NYSE:KW), and Liberty Latin America Ltd. (NASDAQ:LILA). All of these stocks’ market caps are closest to ASND’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AB | 7 | 18133 | 1 |

| RAMP | 18 | 314152 | 3 |

| KW | 13 | 428350 | 1 |

| LILA | 13 | 129644 | 2 |

| Average | 12.75 | 222570 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $223 million. That figure was $1358 million in ASND’s case. LiveRamp Holdings, Inc. (NYSE:RAMP) is the most popular stock in this table. On the other hand AllianceBernstein Holding LP (NYSE:AB) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Ascendis Pharma A/S (NASDAQ:ASND) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on ASND as the stock returned 74.2% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.