It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 18.7% so far in 2019 and outperformed the S&P 500 ETF by 6.6 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards Aratana Therapeutics Inc (NASDAQ:PETX) changed during the first quarter.

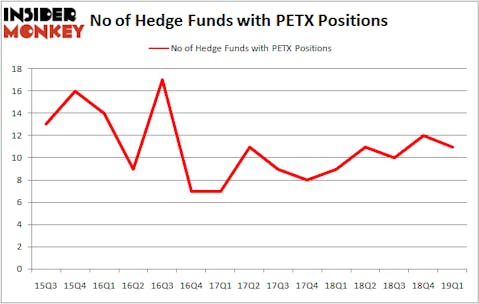

Aratana Therapeutics Inc (NASDAQ:PETX) was in 11 hedge funds’ portfolios at the end of the first quarter of 2019. PETX investors should pay attention to a decrease in enthusiasm from smart money of late. There were 12 hedge funds in our database with PETX holdings at the end of the previous quarter. Our calculations also showed that PETX isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s check out the key hedge fund action regarding Aratana Therapeutics Inc (NASDAQ:PETX).

How have hedgies been trading Aratana Therapeutics Inc (NASDAQ:PETX)?

At Q1’s end, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PETX over the last 15 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

The largest stake in Aratana Therapeutics Inc (NASDAQ:PETX) was held by Broadfin Capital, which reported holding $26.1 million worth of stock at the end of March. It was followed by Engaged Capital with a $8.7 million position. Other investors bullish on the company included Impax Asset Management, Moore Global Investments, and Renaissance Technologies.

Judging by the fact that Aratana Therapeutics Inc (NASDAQ:PETX) has faced bearish sentiment from the smart money, it’s easy to see that there exists a select few fund managers that decided to sell off their entire stakes heading into Q3. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP sold off the largest position of all the hedgies monitored by Insider Monkey, valued at close to $1 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund cut about $0.2 million worth. These moves are interesting, as aggregate hedge fund interest fell by 1 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to Aratana Therapeutics Inc (NASDAQ:PETX). We will take a look at Ardelyx Inc (NASDAQ:ARDX), IDT Corporation (NYSE:IDT), Olympic Steel, Inc. (NASDAQ:ZEUS), and Akoustis Technologies, Inc. (NASDAQ:AKTS). This group of stocks’ market values are similar to PETX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARDX | 12 | 39504 | -2 |

| IDT | 14 | 22240 | 0 |

| ZEUS | 8 | 4368 | 2 |

| AKTS | 8 | 5028 | 4 |

| Average | 10.5 | 17785 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $18 million. That figure was $41 million in PETX’s case. IDT Corporation (NYSE:IDT) is the most popular stock in this table. On the other hand Olympic Steel, Inc. (NASDAQ:ZEUS) is the least popular one with only 8 bullish hedge fund positions. Aratana Therapeutics Inc (NASDAQ:PETX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on PETX as the stock returned 37.5% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.