The market has been volatile in the fourth quarter as the Federal Reserve continued its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of 51job, Inc. (NASDAQ:JOBS) and find out how it is affected by hedge funds’ moves.

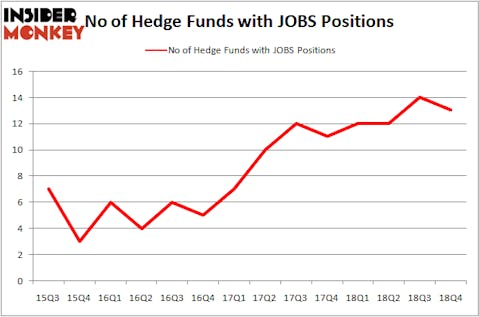

51job, Inc. (NASDAQ:JOBS) has seen a decrease in hedge fund interest of late. Our calculations also showed that JOBS isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action regarding 51job, Inc. (NASDAQ:JOBS).

What does the smart money think about 51job, Inc. (NASDAQ:JOBS)?

Heading into the first quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards JOBS over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Sensato Capital Management held the most valuable stake in 51job, Inc. (NASDAQ:JOBS), which was worth $10.3 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $4.5 million worth of shares. Moreover, Sloane Robinson Investment Management, Indus Capital, and Driehaus Capital were also bullish on 51job, Inc. (NASDAQ:JOBS), allocating a large percentage of their portfolios to this stock.

Due to the fact that 51job, Inc. (NASDAQ:JOBS) has faced declining sentiment from hedge fund managers, logic holds that there were a few hedge funds that decided to sell off their entire stakes last quarter. Interestingly, George McCabe’s Portolan Capital Management sold off the biggest position of all the hedgies followed by Insider Monkey, totaling about $3.6 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund dumped about $3 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 1 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as 51job, Inc. (NASDAQ:JOBS) but similarly valued. These stocks are Blackstone Mortgage Trust Inc (NYSE:BXMT), BlackBerry Limited (NYSE:BB), Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL), and Integra Lifesciences Holdings Corp (NASDAQ:IART). All of these stocks’ market caps are closest to JOBS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BXMT | 16 | 129325 | 2 |

| BB | 23 | 581395 | 5 |

| CBRL | 19 | 196110 | 7 |

| IART | 18 | 129212 | 4 |

| Average | 19 | 259011 | 4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $259 million. That figure was $24 million in JOBS’s case. BlackBerry Limited (NYSE:BB) is the most popular stock in this table. On the other hand Blackstone Mortgage Trust Inc (NYSE:BXMT) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks 51job, Inc. (NASDAQ:JOBS) is even less popular than BXMT. Hedge funds clearly dropped the ball on JOBS as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on JOBS as the stock returned 48.8% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.