Atalan Capital is a New York-based investment fund founded by David Thomas. The fund disclosed an equity portfolio worth $210.81 million as of the end of September, up from $178.71 million reported as of the end of June. Some 38% of the portfolio was allocated towards the technology sector, while 37% were invested in consumer discretionary stocks. According to our calculations, Atalan’s 12 long positions in companies with market capitalization above $1.0 billion had a weighted average return of 14.10% in the third quarter, based on the size of these positions at the end of June.

Insider Monkey’s research has consistently proved that copying hedge funds’ for their long positions in companies with a non-microcap market worth is worthwhile in picking stocks. Overall returns of hedge funds are not impressive, due to the fact that they incorporate hedged returns and losses that mainly come from short side of portfolios.

Having said that, let’s take a closer look at some of Atalan’s top picks.

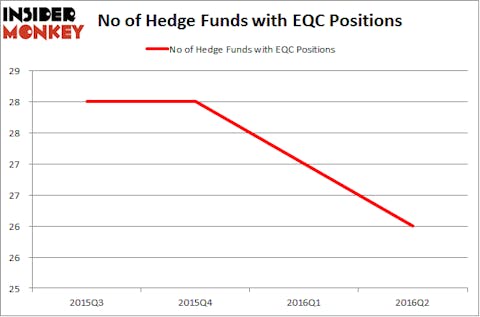

Atalan Capital inched up its position in Equity Commonwealth (NYSE: EQC) by 3% in the second quarter and by 6% in the third one. In this way, the fund held 796,121 shares worth $24.06 million at the end of September, while the stock went up by 3.7% during the third quarter. At the end of June, a total of 26 funds tracked by Insider Monkey held long positions in this stock, down by 4% from the previous quarter. More specifically, Governors Lane was the largest shareholder of Equity Commonwealth (NYSE:EQC), with a stake worth $56.5 million reported as of the end of June. Trailing Governors Lane was Renaissance Technologies, which amassed a stake valued at $49.8 million. D E Shaw, Numina Capital, and QVT Financial also held valuable positions in the company.

Follow Equity Commonwealth (NYSE:EQC)

Follow Equity Commonwealth (NYSE:EQC)

Receive real-time insider trading and news alerts

Then there’s Ball Corporation (NYSE:BLL), whose stock returned 13.5% during the third quarter as the fund cut its stake by 67% to 92,300 shares worth $7.56 million. Ball Corporation (NYSE:BLL) was included in the equity portfolios of 42 funds from our database at the end of June, up from 40 funds a quarter earlier. Among these funds, Senator Investment Group held the most valuable stake in Ball Corporation (NYSE:BLL), which was worth $387 million at the end of the second quarter. On the second spot was Corvex Capital which amassed $250 millions worth of shares. Moreover, Perry Capital, Citadel Investment Group, and Brookside Capital were also bullish on Ball Corporation (NYSE:BLL).

Follow Ball Corp (NYSE:BALL)

Follow Ball Corp (NYSE:BALL)

Receive real-time insider trading and news alerts

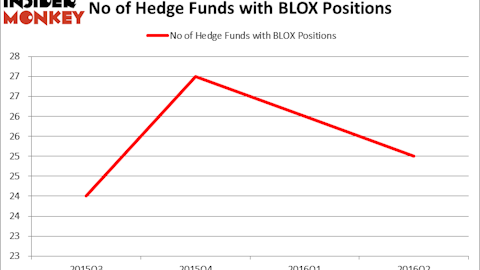

In Infoblox Inc (NYSE:BLOX), Atalan had boosted its stake by 40% in the second quarter, but trimmed it by 13% in the following three months amid a 40.6% growth registered by the stock. The fund ended last quarter with a $21.18 million stake containing 803,095 shares. During the second quarter, the number of funds from our database long Infoblox inched down by one to 26. More specifically, Jonathan Auerbach’s Hound Partners had the biggest position in Infoblox Inc (NYSE:BLOX), worth close to $78.5 million at the end of June. Sitting at the No. 2 spot was Starboard Value LP, managed by Jeffrey Smith, which held a $72.2 million position. Remaining professional money managers that were bullish included Ryan Frick and Oliver Evans’s Dorsal Capital Management, Eric Bannasch’s Cadian Capital and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Follow Infoblox Inc (AMEX:BLOX)

Follow Infoblox Inc (AMEX:BLOX)

Receive real-time insider trading and news alerts

Atalan Capital inched down its stake in FleetCor Technologies, Inc. (NYSE:FLT) by 2% to 102,000 shares worth $17.72 million during the third quarter, as the stock surged by 21.4% in the same period. A total of 52 investors followed by our team were bullish on this stock heading into the third quarter, a change of 8% from the end of March. Lone Pine Capital, managed by Stephen Mandel, held the most valuable position in FleetCor Technologies, Inc. (NYSE:FLT), which was valued at $823.1 million at the end of June. On Lone Pine Capital’s heels was Tiger Global Management LLC, managed by Chase Coleman, which reported a $466.6 million stake. Some other hedge funds and institutional investors with similar optimism included of Daniel S. Och’s OZ Management, John Griffin’s Blue Ridge Capital and Eric W. Mandelblatt’s Soroban Capital Partners.

Follow Corpay Inc. (NYSE:CPAY)

Follow Corpay Inc. (NYSE:CPAY)

Receive real-time insider trading and news alerts

Disclosure: none