According to research conducted in 2011 by the United States Department of Agriculture, the average American consumes approximately 2,000 pounds of food every year. This includes 185 pounds of meat, 85 pounds of fats and oils, 415 pounds of vegetables, and 630 pounds of milk and milk products. As a result of this consumption, U.S. fast food restaurants produce three billion gallons of used cooking oil and one billion gallons of animal fat waste annually. This huge production of domestic and animal waste creates a problem regarding disposal.

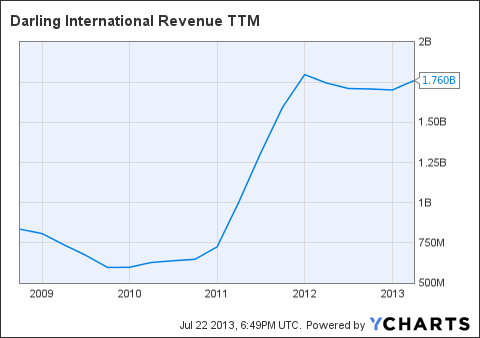

Thankfully though, Darling International Inc. (NYSE:DAR) recycles this waste and converts it into usable, edible products. The company has been in the waste recycling business for more than 130 years. In the last three years of operation, Darling experienced a spike in growth, with the company reporting revenue of more than $1.7 billion in 2012, growing at a CAGR of more than 40% in the last three years.

Going green

Diamond Green Diesel, or DGD, is a 50-50 joint venture project between Darling International Inc. (NYSE:DAR) and Valero Energy Corporation (NYSE:VLO). This joint venture will convert animal fats, used cooking oil, and other economically and commercially viable feed stock into renewable diesel. DGD converts these raw materials (supplied by Darling) into renewable diesel, which Valero transports using its network. The financing for this $413 million project was secured internally from a subsidiary of Valero Energy Corporation (NYSE:VLO) in May 2011.

The plant has a maximum capacity to produce 9,300 barrels per day of renewable diesel, translating to an annual capacity of 137 million gallons per year of renewable diesel. This amounts to diesel conversion of approximately 11% of America’s animal fat and used cooking oil. Renewable diesel has all the properties of petroleum-based diesel, but it reduces greenhouse gases by more than 80% compared to conventional diesel.

In June 2013, plant construction was completed and production began. With the gradual depletion of non-renewable energy sources, the demand for renewable sources of energy is increasing rapidly. In 2012, global investments of $244 billion were made in new renewable sources. Global renewable diesel production reached 22.5 billion liters in 2012, growing at a CAGR of 10.3% since 2010. This signifies the potential that exists for Darling International Inc. (NYSE:DAR) and Valero moving forward.

Considering 10% annual growth, the global biodiesel production will be 24.75 billion liters in 2013 and 27.2 billion liters in 2014. The DGD project has an annual capacity of 520 million liters (137 million gallons) in 2013. This capacity can be expanded to 675 million liters (178 million gallons) in 2014, by spending $50 million-$100 million funded from the joint venture earnings. This implies that this project will produce 2.1% of the world’s biodiesel in 2013, improving to 2.5% in 2014.

Standing strong against competition

Bunge Limited produces oilseed-based biodiesel at its joint venture facilities in the Americas. Bunge oilseed processing plants also act as an important supplier of vegetable oil to major players in the biodiesel industry. The DGD joint venture project, which produces biodiesel in house, will be a significant threat to Bunge’s oilseed processing and biodiesel business.

Renewable Energy Group Inc (NASDAQ:REGI), or REG, is a biodiesel producer that converts natural fats, oils, and greases into biodiesel. REG is a market leader in North America and has presence across the continent. The company’s six bio-refinery plants have an annual capacity of 225 million gallons of biodiesel production capacity.

Darling International Inc. (NYSE:DAR)’s DGD, with an annual capacity of 137 million gallons, has more than 60% of REG’s total capacity. There is significant potential for future expansion for Darling, considering that this is its first green diesel project. The success of this joint venture will fuel expansion efforts, or more joint venture projects, from the two companies in order to beat competition.