A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended June 30, so let’s proceed with the discussion of the hedge fund sentiment on Chevron Corporation (NYSE:CVX).

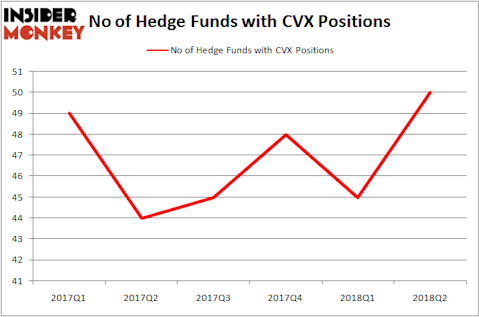

Chevron Corporation (NYSE:CVX), one of the 10 Most Generous Companies In The US, was owned by 50 hedge funds in our database as of June 30, an 11% increase during Q2. A dividend aristocrat, Chevron has made dividend payments for 31 straight years and landed in 19th place among the 25 Best Dividend Stocks for Retirement. Billionaire Ken Fisher, an avid dividend investor, owned 4.61 million Chevron shares on September 30.

In the financial world there are several formulas market participants employ to appraise stocks. Two of the most underrated formulas are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the best investment managers can outpace the market by a very impressive amount (see the details here).

How have hedgies been trading Chevron Corporation (NYSE:CVX)?

At the end of the third quarter, a total of 50 of the hedge funds tracked by Insider Monkey held long positions in this stock, a gain of 11% from one quarter earlier. On the other hand, there were a total of 48 hedge funds with a bullish position in CVX at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Ken Fisher’s Fisher Asset Management was the largest shareholder of Chevron Corporation (NYSE:CVX), with a stake worth $555.6 million reported as of the end of June. Trailing Fisher Asset Management was Adage Capital Management, which amassed a stake valued at $286.7 million. Glaxis Capital Management, Skybridge Capital, and 3G Capital were also very fond of the stock, giving the stock large weights in their portfolios.

With general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Glaxis Capital Management, managed by Paul Holland and Matthew Miller, established a new position in Chevron Corporation (NYSE:CVX) worth $1.5 million invested as of the end of the quarter. Jorge Paulo Lemann’s 3G Capital also initiated a $37.9 million position during the quarter. The other funds with new positions in the stock are Ernest Chow and Jonathan Howe’s Sensato Capital Management, Till Bechtolsheimer’s Arosa Capital Management, and Zach Schreiber’s Point State Capital.

Let’s check out hedge fund activity in other stocks similar to Chevron Corporation (NYSE:CVX). We will take a look at Nestle SA Reg Shs. Ser. B Spons (ADR) (OTCMKTS:NSRGY), UnitedHealth Group Inc. (NYSE:UNH), AT&T Inc. (NYSE:T), and Intel Corporation (NASDAQ:INTC). This group of stocks’ market values are similar to CVX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NSRGY | 5 | 1483813 | 0 |

| UNH | 68 | 6526083 | 1 |

| T | 94 | 3043401 | 55 |

| INTC | 62 | 4570908 | 11 |

As you can see these stocks had an average of 57 hedge funds with bullish positions and the average amount invested in these stocks was $3.91 billion. That figure was $2.40 billion in CVX’s case. AT&T Inc. (NYSE:T) is the most popular stock in this table. On the other hand Nestle SA Reg Shs. Ser. B Spons (ADR) (OTCMKTS:NSRGY) is the least popular one with only 5 bullish hedge fund positions. Chevron Corporation (NYSE:CVX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on, though we recommend investors looking for a reliable dividend stock take a deeper look.

Disclosure: None. This article was originally published at Insider Monkey.