During the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 7 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Bunge Limited (NYSE:BG) and see how the stock is affected by the recent hedge fund activity.

Is Bunge Limited (NYSE:BG) a buy, sell, or hold? The best stock pickers are turning less bullish. The number of bullish hedge fund bets retreated by 1 recently. Our calculations also showed that BG isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s analyze the new hedge fund action encompassing Bunge Limited (NYSE:BG).

How are hedge funds trading Bunge Limited (NYSE:BG)?

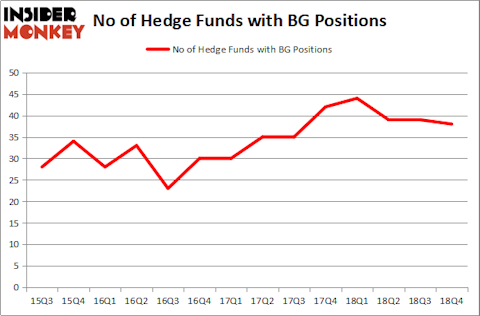

At the end of the fourth quarter, a total of 38 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -3% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BG over the last 14 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, Carlson Capital was the largest shareholder of Bunge Limited (NYSE:BG), with a stake worth $151.2 million reported as of the end of September. Trailing Carlson Capital was Citadel Investment Group, which amassed a stake valued at $127.6 million. Point72 Asset Management, Adage Capital Management, and Discovery Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Bunge Limited (NYSE:BG) has witnessed falling interest from hedge fund managers, we can see that there exists a select few fund managers who were dropping their full holdings in the third quarter. At the top of the heap, Jacob Doft’s Highline Capital Management sold off the biggest stake of all the hedgies watched by Insider Monkey, valued at close to $110.1 million in stock, and Malcolm Fairbairn’s Ascend Capital was right behind this move, as the fund said goodbye to about $27.7 million worth. These transactions are interesting, as total hedge fund interest fell by 1 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to Bunge Limited (NYSE:BG). These stocks are Ultrapar Participacoes SA (NYSE:UGP), CPFL Energia S.A. (NYSE:CPL), Alaska Air Group, Inc. (NYSE:ALK), and Jazz Pharmaceuticals Public Limited Company (NASDAQ:JAZZ). All of these stocks’ market caps are similar to BG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UGP | 3 | 49830 | -5 |

| CPL | 2 | 15394 | 0 |

| ALK | 32 | 453480 | 12 |

| JAZZ | 31 | 597051 | 2 |

| Average | 17 | 278939 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $279 million. That figure was $875 million in BG’s case. Alaska Air Group, Inc. (NYSE:ALK) is the most popular stock in this table. On the other hand CPFL Energia S.A. (NYSE:CPL) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Bunge Limited (NYSE:BG) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately BG wasn’t in this group. Hedge funds that bet on BG were disappointed as the stock returned 1.1% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.