At Insider Monkey we follow around 700 of the best-performing investors and even though many of them lost money in the last couple of months (70% of hedge funds lost money in October whereas S&P 500 ETF lost about 7%), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

Boston Scientific Corporation (NYSE:BSX) has experienced an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that BSX isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to the beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the key hedge fund action surrounding Boston Scientific Corporation (NYSE:BSX).

Hedge fund activity in Boston Scientific Corporation (NYSE:BSX)

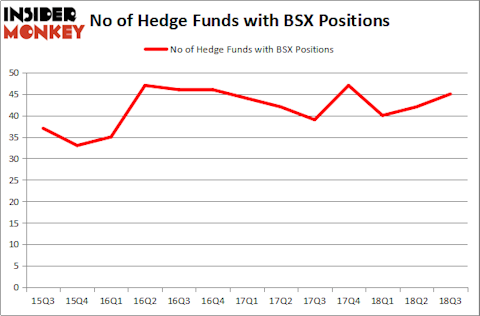

At Q3’s end, a total of 45 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from one quarter earlier. By comparison, 47 hedge funds held shares or bullish call options in BSX heading into this year. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ken Griffin’s Citadel Investment Group has the biggest position in Boston Scientific Corporation (NYSE:BSX), worth close to $314.4 million, comprising 0.1% of its total 13F portfolio. Coming in second is Samuel Isaly of OrbiMed Advisors, with a $302.8 million position; the fund has 3.6% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism consist of Doug Silverman and Alexander Klabin’s Senator Investment Group, Israel Englander’s Millennium Management and Phill Gross and Robert Atchinson’s Adage Capital Management.

As one would reasonably expect, key hedge funds were breaking ground themselves. Viking Global, managed by Andreas Halvorsen, initiated the biggest position in Boston Scientific Corporation (NYSE:BSX). Viking Global had $121.5 million invested in the company at the end of the quarter. Aaron Cowen’s Suvretta Capital Management also made a $91.5 million investment in the stock during the quarter. The following funds were also among the new BSX investors: Glenn Russell Dubin’s Highbridge Capital Management, Frank Brosens’s Taconic Capital, and Benjamin A. Smith’s Laurion Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Boston Scientific Corporation (NYSE:BSX). These stocks are America Movil SAB de CV (NYSE:AMX), Honda Motor Co Ltd (NYSE:HMC), Bank of Montreal (NYSE:BMO), and Micron Technology, Inc. (NASDAQ:MU). This group of stocks’ market caps match BSX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMX | 10 | 265643 | 0 |

| HMC | 11 | 117617 | -2 |

| BMO | 13 | 658815 | 0 |

| MU | 59 | 4083502 | -7 |

| Average | 23.25 | 1281 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.28 billion. That figure was $2.42 billion in BSX’s case. Micron Technology, Inc. (NASDAQ:MU) is the most popular stock in this table. On the other hand America Movil SAB de CV (NYSE:AMX) is the least popular one with only 10 bullish hedge fund positions. Boston Scientific Corporation (NYSE:BSX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MU might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.