The financial regulations require hedge funds and wealthy investors that exceeded the $100 million holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 30th. We at Insider Monkey have made an extensive database of more than 873 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Blueprint Medicines Corporation (NASDAQ:BPMC) based on those filings.

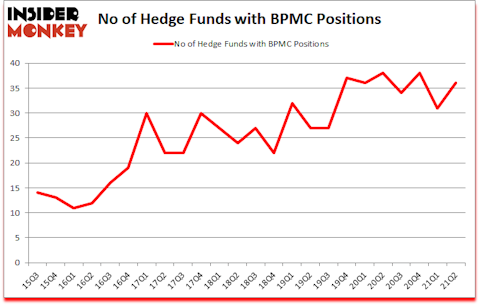

Blueprint Medicines Corporation (NASDAQ:BPMC) investors should be aware of an increase in enthusiasm from smart money recently. Blueprint Medicines Corporation (NASDAQ:BPMC) was in 36 hedge funds’ portfolios at the end of June. The all time high for this statistic is 38. There were 31 hedge funds in our database with BPMC holdings at the end of March. Our calculations also showed that BPMC isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Kris Jenner of Rock Springs Capital Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, we like undervalued, EBITDA-positive growth stocks, so we are checking out stock pitches like this emerging biotech stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to take a look at the latest hedge fund action encompassing Blueprint Medicines Corporation (NASDAQ:BPMC).

Do Hedge Funds Think BPMC Is A Good Stock To Buy Now?

At second quarter’s end, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 16% from one quarter earlier. On the other hand, there were a total of 38 hedge funds with a bullish position in BPMC a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Casdin Capital, managed by Eli Casdin, holds the largest position in Blueprint Medicines Corporation (NASDAQ:BPMC). Casdin Capital has a $136.3 million position in the stock, comprising 3.5% of its 13F portfolio. The second most bullish fund manager is Cadian Capital, managed by Eric Bannasch, which holds a $116.2 million position; 5.2% of its 13F portfolio is allocated to the company. Remaining professional money managers that are bullish include Farallon Capital, Panayotis Takis Sparaggis’s Alkeon Capital Management and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management. In terms of the portfolio weights assigned to each position Aquilo Capital Management allocated the biggest weight to Blueprint Medicines Corporation (NASDAQ:BPMC), around 10.25% of its 13F portfolio. Cadian Capital is also relatively very bullish on the stock, dishing out 5.16 percent of its 13F equity portfolio to BPMC.

As aggregate interest increased, key hedge funds were breaking ground themselves. Point72 Asset Management, managed by Steve Cohen, created the most valuable position in Blueprint Medicines Corporation (NASDAQ:BPMC). Point72 Asset Management had $22.9 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $10.1 million position during the quarter. The following funds were also among the new BPMC investors: Paul Tudor Jones’s Tudor Investment Corp, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Sander Gerber’s Hudson Bay Capital Management.

Let’s check out hedge fund activity in other stocks similar to Blueprint Medicines Corporation (NASDAQ:BPMC). These stocks are New York Community Bancorp, Inc. (NYSE:NYCB), Travel + Leisure Co. (NYSE:TNL), Flowers Foods, Inc. (NYSE:FLO), Signify Health, Inc. (NYSE:SGFY), CIT Group Inc. (NYSE:CIT), Switch, Inc. (NYSE:SWCH), and Apellis Pharmaceuticals, Inc. (NASDAQ:APLS). This group of stocks’ market valuations match BPMC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NYCB | 30 | 393811 | 5 |

| TNL | 30 | 668680 | 0 |

| FLO | 21 | 283246 | -5 |

| SGFY | 13 | 167408 | -15 |

| CIT | 30 | 751796 | 2 |

| SWCH | 16 | 243201 | 6 |

| APLS | 31 | 877120 | -3 |

| Average | 24.4 | 483609 | -1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.4 hedge funds with bullish positions and the average amount invested in these stocks was $484 million. That figure was $848 million in BPMC’s case. Apellis Pharmaceuticals, Inc. (NASDAQ:APLS) is the most popular stock in this table. On the other hand Signify Health, Inc. (NYSE:SGFY) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Blueprint Medicines Corporation (NASDAQ:BPMC) is more popular among hedge funds. Our overall hedge fund sentiment score for BPMC is 88.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 21.8% in 2021 through October 11th but still managed to beat the market by 4.4 percentage points. Hedge funds were also right about betting on BPMC as the stock returned 12.2% since the end of June (through 10/11) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Blueprint Medicines Corp (NASDAQ:BPMC)

Follow Blueprint Medicines Corp (NASDAQ:BPMC)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Largest Gaming Companies In The World

- 15 Fastest Growing Food Brands

- Billionaire Andreas Halvorsen’s Top Stock Picks

Disclosure: None. This article was originally published at Insider Monkey.