Billionaire Seth Klarman is a legend among value investors. His fund, Baupost Group, has achieved average annual returns of 17% a year for over 30 years, nearly double the returns of the S&P 500. Because of the great performance, Baupost is now a giant among fish, with an equity portfolio of $6 billion. In this article, we analyze the underlying fundamentals of Klarman’s top five positions of Micron Technology, Inc. (NASDAQ:MU), eBay Inc (NASDAQ:EBAY), Pioneer Natural Resources (NYSE:PXD), ViaSat, Inc. (NASDAQ:VSAT), and Cheniere Energy, Inc. (NYSE:LNG) as well as reveal how each of his top five picks performed in the third quarter. Baupost invests only a small percentage of its assets in stocks and maintains a long-term view. Even though these stocks may underperform in the short-term, based on Klarman’s track record we can say that they are likely to generate meaningful returns over the long-term. By the way, famous short seller Jim Chanos doesn’t like most of these stock picks and he specifically talked about one of these stocks a couple of days ago. We will share his views at the end of this article.

We mention the portfolio of elite investors such as Seth Klarman because our research has shown that elite funds are extremely talented at picking stocks on the long side of their portfolios. It is true that hedge fund investors have been underperforming the market in recent years. However, this was mainly because hedge funds’ short stock picks lost a ton of money during the bull market that started in March 2009. Hedge fund investors also paid an arm and a leg for the services that they received. We have been tracking the performance of hedge funds’ 15 most popular small-cap stock picks in real time since the end of August 2012. These stocks have returned 102% since then and outperformed the S&P 500 Index by around 53 percentage points (see the details here). That’s why we believe it is important to pay attention to hedge fund sentiment; we also don’t like paying huge fees.

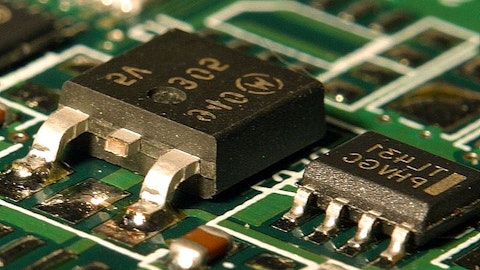

#5 Micron Technology, Inc. (NASDAQ:MU)

– Shares held (as of June 30): 19.7 million

– Total Value (as of June 30): $371 million

– Percent of Portfolio (as of June 30): 6.18%

Micron shares were off 20% in the third quarter as investors worried about industry oversupply and lower DRAM pricing. Investors also worried about PC’s secular decline, as research firm IDC expects worldwide PC shipments to fall by 8.7% in 2015 and ‘not stabilize until 2017’. The recent launch of Windows 10 hasn’t reinvigorated sales as much as the optimists had hoped.

Still, Micron has great long term value, as evidence by Tsinghua Unigroup’s offer for Micron which was dismissed as untenable due to national security concerns. Micron shares have rallied somewhat from their 52 week lows and trade at a reasonable 7.88 times forward earnings. Other hedge fund holders long Micron include David Einhorn‘s Greenlight Capital and David Shaw’s D E Shaw.

Follow Micron Technology Inc (NASDAQ:MU)

Follow Micron Technology Inc (NASDAQ:MU)

Receive real-time insider trading and news alerts

#4 eBay Inc (NASDAQ:EBAY)

– Shares held (as of June 30): 9.32 million

– Total Value (as of June 30): $561 million

– Percent of Portfolio (as of June 30): 9.35%

Ebay shares fell 3.6% in the third quarter as the broader market trended lower and the PayPal spin off failed to unlock value for shareholders. Given Ebay’s forward PE of 12.7 and the expected next five year EPS growth rate of 10.4% a year, shares look attractive, although management will need to innovate to protect its market share against social media companies Facebook and Twitter, as well as Ebay’s arch nemesis Amazon. Shares could rally if management decides to do bigger share buybacks or pay a dividend. Other top investors holding Ebay include Carl Icahn‘s Icahn Capital Lp and Barry Rosenstein’s Jana Partners.

Follow Ebay Inc (NASDAQ:EBAY)

Follow Ebay Inc (NASDAQ:EBAY)

Receive real-time insider trading and news alerts