Giverny Capital recently released its Q1 2020 Investor Letter, a copy of which you can download below. You should check out Giverny Capital’s top 5 stock picks for investors to buy right now, which could be the biggest winners of the stock market crash. There weren’t a lot of funds who could deliver these kinds of returns without shorting the market or using aggressive put options.

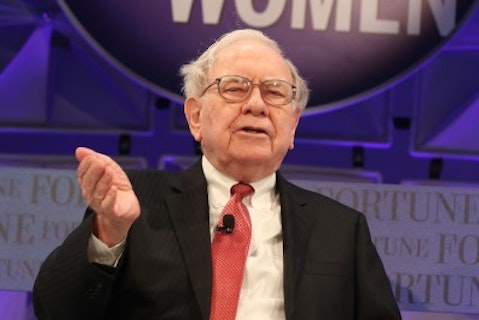

In the said letter, Giverny Capital highlighted a few stocks and Berkshire Hathaway Inc (NYSE:BRK-B) is one of them. Berkshire Hathaway is a multinational conglomerate holding company. Year-to-date, Berkshire Hathaway Inc (NYSE:BRK-B) stock lost 20.2%. Here is what Giverny Capital said:

“Our third-largest holding is Berkshire Hathaway at 6.5% of the portfolio. We feel fairly confident saying Berkshire will not be GCAM’s performance leader in the years to come. It is so large that CEO Warren Buffett’s investment options are limited to giant companies, which themselves often have limited prospects for future growth. Similarly, the current business mosaic consists of mostly mature US businesses that do not set the heart to racing. But that steady portfolio throws off enormous amounts of cash for Mr. Buffett to reinvest and at a recent quote of $180 for the B shares, the whole collection trades for about book value at the end of 2019. We view Berkshire as something of a hedge against a prolonged recession – it has more than $100 billion in cash it could invest and past experience shows us that beleaguered CEOs trek to Omaha, hat in hand, looking for Berkshire’s help in troubled times.

In recent years, Berkshire’s new investments have not performed up to our expectations. For every Apple, there has been a Precision Castparts or a Kraft Heinz. But we don’t lose sleep owning this collection of good companies attached to a wheelbarrow filled with cash. We would be thrilled if Buffett dedicated billions to stock repurchase at current prices, but short of that, we’ll watch the cash pile higher in our wheelbarrow.”

However, don’t write off Berkshire Hathaway yet as it has a huge amount of cash right now which can be used to go on an acquisition spree-check out here for details. Our calculations showed that Berkshire Hathaway Inc (NYSE:BRK-B) is ranked #13 among the 30 most popular stocks among hedge funds.

The top 10 stocks among hedge funds returned 185% since the end of 2014 and outperformed the S&P 500 Index ETFs by more than 109 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Below you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

Video: Top 5 Stocks Among Hedge Funds

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we asked astrophysicist Neil deGrasse Tyson about Tesla, Elon Musk, and his top stock picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. You can subscribe to our free enewsletter below to receive our stories in your inbox:

Disclosure: None. This article is originally published at Insider Monkey.