We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Avista Corp (NYSE:AVA) based on that data.

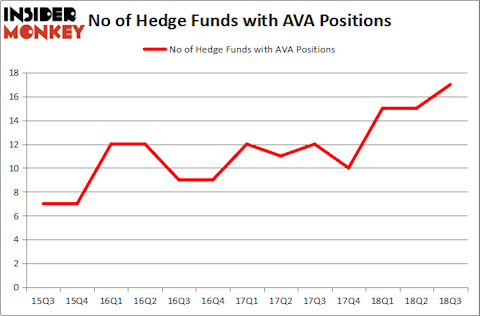

Avista Corp (NYSE:AVA) has experienced an increase in activity from the world’s largest hedge funds in recent months. AVA was in 17 hedge funds’ portfolios at the end of the third quarter of 2018. There were 15 hedge funds in our database with AVA holdings at the end of the previous quarter. Our calculations also showed that AVA isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are perceived as underperforming, outdated financial tools of yesteryear. While there are greater than 8,000 funds trading at present, Our researchers choose to focus on the top tier of this group, around 700 funds. These investment experts preside over the majority of the smart money’s total capital, and by keeping an eye on their first-class investments, Insider Monkey has deciphered a few investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a gander at the recent hedge fund action surrounding Avista Corp (NYSE:AVA).

What have hedge funds been doing with Avista Corp (NYSE:AVA)?

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the second quarter of 2018. By comparison, 10 hedge funds held shares or bullish call options in AVA heading into this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Magnetar Capital, managed by Alec Litowitz and Ross Laser, holds the number one position in Avista Corp (NYSE:AVA). Magnetar Capital has a $160.2 million position in the stock, comprising 2.9% of its 13F portfolio. The second largest stake is held by Thomas Steyer of Farallon Capital, with a $74.3 million position; 0.4% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that hold long positions contain Matthew Halbower’s Pentwater Capital Management, Richard Gerson and Navroz D. Udwadia’s Falcon Edge Capital and Michel Massoud’s Melqart Asset Management.

As one would reasonably expect, key hedge funds have jumped into Avista Corp (NYSE:AVA) headfirst. Falcon Edge Capital, managed by Richard Gerson and Navroz D. Udwadia, assembled the most valuable position in Avista Corp (NYSE:AVA). Falcon Edge Capital had $52 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $0.7 million investment in the stock during the quarter. The only other fund with a new position in the stock is David Andre and Astro Teller’s Cerebellum Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Avista Corp (NYSE:AVA). These stocks are Bank of Hawaii Corporation (NYSE:BOH), Holly Energy Partners, L.P. (NYSE:HEP), KapStone Paper and Packaging Corp. (NYSE:KS), and UniFirst Corp (NYSE:UNF). This group of stocks’ market values are closest to AVA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BOH | 12 | 85295 | 1 |

| HEP | 3 | 4584 | 0 |

| KS | 21 | 489664 | -2 |

| UNF | 16 | 185010 | 5 |

| Average | 13 | 191138 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $191 million. That figure was $481 million in AVA’s case. KapStone Paper and Packaging Corp. (NYSE:KS) is the most popular stock in this table. On the other hand Holly Energy Partners, L.P. (NYSE:HEP) is the least popular one with only 3 bullish hedge fund positions. Avista Corp (NYSE:AVA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.