How do we determine whether Ally Financial Inc (NYSE:ALLY) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

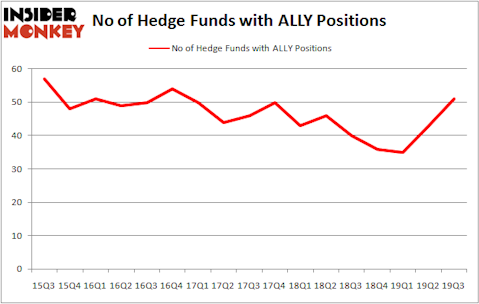

Ally Financial Inc (NYSE:ALLY) shareholders have witnessed an increase in hedge fund interest lately. Our calculations also showed that ALLY isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

George Soros of Soros Fund Management

Let’s take a look at the key hedge fund action encompassing Ally Financial Inc (NYSE:ALLY).

What does smart money think about Ally Financial Inc (NYSE:ALLY)?

Heading into the fourth quarter of 2019, a total of 51 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 19% from the previous quarter. By comparison, 40 hedge funds held shares or bullish call options in ALLY a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Howard Marks’s Oaktree Capital Management has the number one position in Ally Financial Inc (NYSE:ALLY), worth close to $362.9 million, amounting to 7.1% of its total 13F portfolio. Coming in second is Robert Rodriguez and Steven Romick of First Pacific Advisors, with a $212 million position; 2% of its 13F portfolio is allocated to the company. Other professional money managers that are bullish consist of Anthony Bozza’s Lakewood Capital Management, Noam Gottesman’s GLG Partners and Adam Peterson’s Magnolia Capital Fund. In terms of the portfolio weights assigned to each position Glendon Capital Management allocated the biggest weight to Ally Financial Inc (NYSE:ALLY), around 16.29% of its portfolio. Magnolia Capital Fund is also relatively very bullish on the stock, earmarking 14.98 percent of its 13F equity portfolio to ALLY.

Consequently, specific money managers have jumped into Ally Financial Inc (NYSE:ALLY) headfirst. Azora Capital, managed by Ravi Chopra, created the most outsized position in Ally Financial Inc (NYSE:ALLY). Azora Capital had $39.1 million invested in the company at the end of the quarter. Usman Waheed’s Strycker View Capital also initiated a $23.5 million position during the quarter. The other funds with brand new ALLY positions are George Soros’s Soros Fund Management, Dmitry Balyasny’s Balyasny Asset Management, and Gregg Moskowitz’s Interval Partners.

Let’s check out hedge fund activity in other stocks similar to Ally Financial Inc (NYSE:ALLY). These stocks are Icahn Enterprises LP (NASDAQ:IEP), Slack Technologies Inc (NYSE:WORK), Gartner Inc (NYSE:IT), and CBOE Global Markets, Inc (NASDAQ:CBOE). All of these stocks’ market caps resemble ALLY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IEP | 5 | 12357565 | 0 |

| WORK | 27 | 326449 | -10 |

| IT | 19 | 659624 | 2 |

| CBOE | 23 | 1076442 | -1 |

| Average | 18.5 | 3605020 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $3605 million. That figure was $2112 million in ALLY’s case. Slack Technologies Inc (NYSE:WORK) is the most popular stock in this table. On the other hand Icahn Enterprises LP (NASDAQ:IEP) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Ally Financial Inc (NYSE:ALLY) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately ALLY wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ALLY were disappointed as the stock returned -2.3% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.