“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Is AbbVie Inc (NYSE:ABBV) undervalued? The best stock pickers are betting on the stock. The number of bullish hedge fund bets improved by 1 lately. Our calculations also showed that abbv isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

We’re going to analyze the new hedge fund action surrounding AbbVie Inc (NYSE:ABBV).

What have hedge funds been doing with AbbVie Inc (NYSE:ABBV)?

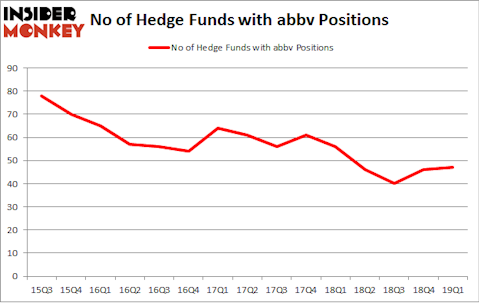

Heading into the second quarter of 2019, a total of 47 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 2% from the previous quarter. By comparison, 56 hedge funds held shares or bullish call options in ABBV a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Orbis Investment Management, managed by William B. Gray, holds the biggest position in AbbVie Inc (NYSE:ABBV). Orbis Investment Management has a $1.4353 billion position in the stock, comprising 9.7% of its 13F portfolio. The second largest stake is held by Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $557.3 million position; the fund has 1.3% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions encompass D. E. Shaw’s D E Shaw, John Overdeck and David Siegel’s Two Sigma Advisors and Cliff Asness’s AQR Capital Management.

Consequently, key hedge funds were leading the bulls’ herd. Millennium Management, managed by Israel Englander, created the most outsized position in AbbVie Inc (NYSE:ABBV). Millennium Management had $33.4 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $26 million position during the quarter. The following funds were also among the new ABBV investors: Steve Cohen’s Point72 Asset Management, David Costen Haley’s HBK Investments, and Efrem Kamen’s Pura Vida Investments.

Let’s also examine hedge fund activity in other stocks similar to AbbVie Inc (NYSE:ABBV). We will take a look at Broadcom Inc (NASDAQ:AVGO), Union Pacific Corporation (NYSE:UNP), Amgen, Inc. (NASDAQ:AMGN), and Honeywell International Inc. (NYSE:HON). This group of stocks’ market values are similar to ABBV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVGO | 53 | 3326352 | 1 |

| UNP | 54 | 4424562 | -1 |

| AMGN | 46 | 2982796 | 0 |

| HON | 56 | 2984847 | -1 |

| Average | 52.25 | 3429639 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 52.25 hedge funds with bullish positions and the average amount invested in these stocks was $3430 million. That figure was $3858 million in ABBV’s case. Honeywell International Inc. (NYSE:HON) is the most popular stock in this table. On the other hand Amgen, Inc. (NASDAQ:AMGN) is the least popular one with only 46 bullish hedge fund positions. AbbVie Inc (NYSE:ABBV) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately ABBV wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ABBV investors were disappointed as the stock returned -2.4% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.