A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Apollo Global Management LLC (NYSE:APO).

There was a small increase during Q3 in the number of hedge funds long Apollo Global Management LLC (NYSE:APO), with 22 of them holding shares at the end of the quarter, up from 19 at the end of June. In its Q2 investor letter, Anthony Bozza‘s Lakewood Capital Management shared its thoughts on some of its long and short ideas, including Citigroup Inc. (NYSE:C), Axon Enterprise, Inc. (NASDAQ:AAXN), Baidu, Inc. (NASDAQ:BIDU), AeroVironment, Inc. (NYSE:AVAV), and Apollo Global Management, LLC (NYSE:APO). About the latter it wrote that shares could hit $52 around the end of 2019, nearly double their current value.

“We expect Apollo will generate management fee income of $1.40 per share in two years. This estimate assumes very little new asset growth and may prove conservative if either Athene or Athora rapidly deploys its excess capital or if Apollo aggressively ramps in newer verticals. We value this management fee stream at 20x earnings, reflecting its growth and predictability (and just a slight premium to traditional asset managers), implying $28 per share of value. We also estimate that the company’s variable incentive fees are worth $15.50 per share, assuming a 10% gross rate of return on the company’s funds and a valuation multiple of just 6x these cash flows (reflecting their risk and volatility). Combining the values of these two earnings streams with our estimate of Apollo’s 2019 book value of $9.50 per share (inclusive of dividends received) would equate to a stock price of $52 per share in 18 months, 45% above current levels and 70% above the fund’s cost basis,” Lakewood Capital Management wrote.

To the average investor there are a multitude of indicators stock traders employ to appraise publicly traded companies. A couple of the most innovative indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the elite money managers can trounce their index-focused peers by a significant margin (see the details here).

What does the smart money think about Apollo Global Management LLC (NYSE:APO)?

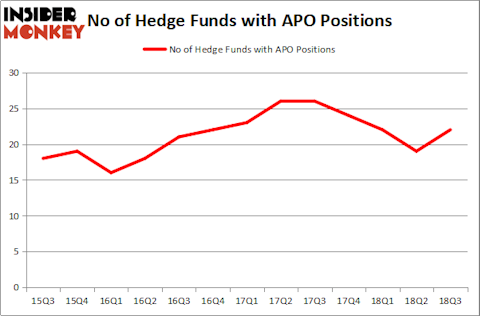

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a 16% increase from the previous quarter. The graph below displays the number of hedge funds with bullish positions in APO over the last 13 quarters. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chase Coleman’s Tiger Global Management LLC has the most valuable position in Apollo Global Management LLC (NYSE:APO), worth close to $1.19 billion, amounting to 5.6% of its total 13F portfolio. Coming in second is HMI Capital, managed by Mick Hellman, which holds a $152.1 million position; the fund has 19.4% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions contain Tom Gayner’s Markel Gayner Asset Management, Robert B. Gillam’s McKinley Capital Management and Julian Robertson’s Tiger Management.

As industry-wide interest jumped, key hedge funds were leading the bulls’ herd. Select Equity Group, managed by Robert Joseph Caruso, assembled the largest position in Apollo Global Management LLC (NYSE:APO). Select Equity Group had $15.9 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $3.9 million position during the quarter. The other funds with new positions in the stock are James Dondero’s Highland Capital Management and Frederick DiSanto’s Ancora Advisors.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Apollo Global Management LLC (NYSE:APO) but similarly valued. We will take a look at Vornado Realty Trust (NYSE:VNO), CMS Energy Corporation (NYSE:CMS), Darden Restaurants, Inc. (NYSE:DRI), and Wynn Resorts, Limited (NASDAQ:WYNN). This group of stocks’ market values are closest to APO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VNO | 25 | 481421 | -1 |

| CMS | 22 | 282246 | 4 |

| DRI | 22 | 980978 | -3 |

| WYNN | 43 | 2481578 | -1 |

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1.06 billion. That figure was $1.52 billion in APO’s case. Wynn Resorts, Limited (NASDAQ:WYNN) is the most popular stock in this table. On the other hand CMS Energy Corporation (NYSE:CMS) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Apollo Global Management LLC (NYSE:APO) is only as popular as CMS and DRI. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to look elsewhere for a good investment opportunity.

Disclosure: None. This article was originally published at Insider Monkey.