It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2018) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Amphenol Corporation (NYSE:APH).

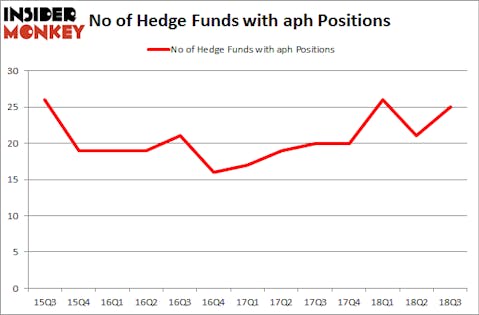

Amphenol Corporation (NYSE:APH) has seen an increase in hedge fund sentiment recently. APH was in 25 hedge funds’ portfolios at the end of the third quarter of 2018. There were 21 hedge funds in our database with APH holdings at the end of the previous quarter. Our calculations also showed that aph isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s check out the key hedge fund action regarding Amphenol Corporation (NYSE:APH).

How have hedgies been trading Amphenol Corporation (NYSE:APH)?

Heading into the fourth quarter of 2018, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 19% from the previous quarter. The graph below displays the number of hedge funds with bullish position in APH over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Select Equity Group, managed by Robert Joseph Caruso, holds the number one position in Amphenol Corporation (NYSE:APH). Select Equity Group has a $274.9 million position in the stock, comprising 2% of its 13F portfolio. On Select Equity Group’s heels is Adage Capital Management, led by Phill Gross and Robert Atchinson, holding a $29.1 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining peers that are bullish contain Brian Ashford-Russell and Tim Woolley’s Polar Capital, D. E. Shaw’s D E Shaw and Steve Cohen’s Point72 Asset Management.

As aggregate interest increased, key money managers have been driving this bullishness. Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, initiated the largest position in Amphenol Corporation (NYSE:APH). Polar Capital had $28.8 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $9.8 million position during the quarter. The other funds with new positions in the stock are Glenn Russell Dubin’s Highbridge Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Jim O’Brien and Jonathan Dorfman’s Napier Park Global Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Amphenol Corporation (NYSE:APH) but similarly valued. We will take a look at Archer Daniels Midland Company (NYSE:ADM), Sirius XM Holdings Inc (NASDAQ:SIRI), O’Reilly Automotive Inc (NASDAQ:ORLY), and ONEOK, Inc. (NYSE:OKE). This group of stocks’ market caps are closest to APH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADM | 32 | 771684 | 11 |

| SIRI | 24 | 1277620 | -2 |

| ORLY | 43 | 2035471 | 3 |

| OKE | 31 | 517916 | 6 |

| Average | 32.5 | 1150673 | 4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.15 billion. That figure was $471 million in APH’s case. O’Reilly Automotive Inc (NASDAQ:ORLY) is the most popular stock in this table. On the other hand Sirius XM Holdings Inc (NASDAQ:SIRI) is the least popular one with only 24 bullish hedge fund positions. Amphenol Corporation (NYSE:APH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ORLY might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.