Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about American International Group Inc (NYSE:AIG).

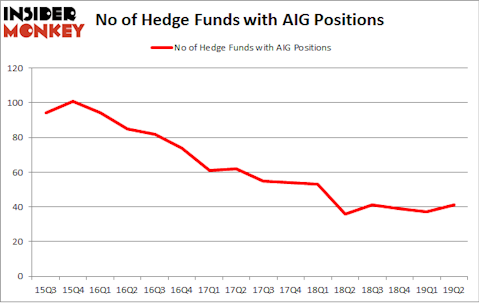

Is American International Group Inc (NYSE:AIG) the right investment to pursue these days? Hedge funds are in a bullish mood. The number of bullish hedge fund positions rose by 4 recently. Our calculations also showed that AIG isn’t among the 30 most popular stocks among hedge funds (see the video at the end of this article). AIG was in 41 hedge funds’ portfolios at the end of the second quarter of 2019. There were 37 hedge funds in our database with AIG positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a peek at the recent hedge fund action surrounding American International Group Inc (NYSE:AIG).

Hedge fund activity in American International Group Inc (NYSE:AIG)

At Q2’s end, a total of 41 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards AIG over the last 16 quarters. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Among these funds, First Pacific Advisors LLC held the most valuable stake in American International Group Inc (NYSE:AIG), which was worth $790.8 million at the end of the second quarter. On the second spot was Pzena Investment Management which amassed $580.5 million worth of shares. Moreover, Diamond Hill Capital, Balyasny Asset Management, and Adage Capital Management were also bullish on American International Group Inc (NYSE:AIG), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds have been driving this bullishness. Balyasny Asset Management, managed by Dmitry Balyasny, initiated the biggest position in American International Group Inc (NYSE:AIG). Balyasny Asset Management had $96.4 million invested in the company at the end of the quarter. Andreas Halvorsen’s Viking Global also made a $30.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Daniel Johnson’s Gillson Capital, Bruce Kovner’s Caxton Associates LP, and Jeffrey Talpins’s Element Capital Management.

Let’s check out hedge fund activity in other stocks similar to American International Group Inc (NYSE:AIG). We will take a look at Kimberly-Clark Corporation (NYSE:KMB), Infosys Limited (NYSE:INFY), HCA Healthcare Inc (NYSE:HCA), and UBS Group AG (NYSE:UBS). This group of stocks’ market values resemble AIG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KMB | 40 | 1546551 | 4 |

| INFY | 25 | 1151865 | 5 |

| HCA | 51 | 3049357 | 0 |

| UBS | 14 | 796197 | 3 |

| Average | 32.5 | 1635993 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.5 hedge funds with bullish positions and the average amount invested in these stocks was $1636 million. That figure was $2270 million in AIG’s case. HCA Healthcare Inc (NYSE:HCA) is the most popular stock in this table. On the other hand UBS Group AG (NYSE:UBS) is the least popular one with only 14 bullish hedge fund positions. American International Group Inc (NYSE:AIG) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on AIG, though not to the same extent, as the stock returned 5.1% during the third quarter and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.