E-commerce is a megatrend that retail investors should be looking to capitalize on. At a time where overall U.S. consumer spending has crept along at an average annual growth rate of under 2%, e-commerce has been growing by leaps and bounds. E-tail sales were up by 15% in 2012.

Opportunities abound, especially if you’re willing to zig while others zag. We’ll take a look at one of those more ziggy opportunities below.

But first, let’s face it. When it comes to investing opportunities in e-commerce, Amazon.com, Inc. (NASDAQ:AMZN) is the elephant in the room.

Amazon.com, Inc. (NASDAQ:AMZN) also sells at a price that makes many investors – including this one – cringe. Forward earnings estimates for Amazon come in somewhere between $1.39 and $1.67 a share in 2013. That puts the e-tail giant selling at a 1-year forward PE of somewhere between 159 and 190.

What’s more, Amazon’s continuing plans to get products to consumers faster has brought with it many new warehouses – ongoing expenses that could zap margins for years to come.

All that makes Amazon a risky proposition.

But it just so happens that there’s another fast-growing e-commerce play with an already dominant position and bright prospects for accelerating growth. And this one sells at a very reasonable multiple of around 20 times forward earnings.

It also happens to be a name with which you’re probably very familiar: eBay Inc (NASDAQ:EBAY). That’s right. One of the true progenitors of e-commerce is also still – or perhaps, again – one of its leaders.

Although eBay Inc (NASDAQ:EBAY) hasn’t taken the world by storm over the past several years the way Amazon has, it has managed to reach its tentacles out into many areas of e-commerce. Its flagship and namesake market, eBay, is again growing, with quarterly revenues up 16% over the prior year. But eBay’s portfolio also includes a number of other brands, some more significant to its future, in PayPal, BillMeLater and StubHub.

PayPal revenues now represent 39% of eBay’s revenues, and they are growing at a clip of 24% year over year, driving much of eBay’s growth. The company’s overall annual revenues are up by an average of better than 20% since 2009.

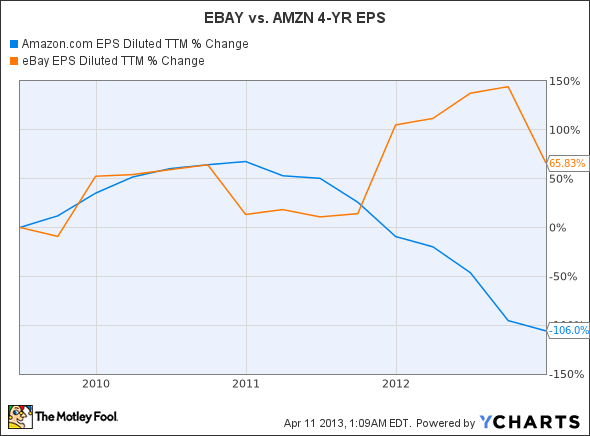

Sure, that trails Amazon.com, Inc. (NASDAQ:AMZN)’s near 50% annual revenue growth rate over that time. Still, it’s not too shabby. And eBay Inc (NASDAQ:EBAY) has shined brighter than Amazon in turning those revenues into profits. Earnings since 2009 have grown by 192% for eBay, while Amazon’s have shrunk.

Here’s a quick look at how the two stack up in earnings since April 2009:

AMZN EPS Diluted TTM data by YCharts

Moving ahead

Let’s take a closer look at eBay Inc (NASDAQ:EBAY)’s position in the industry. In 2012, eBay’s various brands were involved in more than $175 billion of retail sales. That means that the company is now involved in 19% of global e-commerce and almost 2% of total global retail, CEO John Donahoe says.

Those are some impressive numbers.

What lies ahead for eBay, as Donahoe says, are “substantial long-term growth opportunities.” He expects them to come from a number of eBay’s brands, including PayPal, BillMeLater and the flagship eBay market.

PayPal was used in some 700 million payments transactions in the fourth quarter of 2012, the company reported. As the world’s most popular digital wallet service, it now has 123 million active accounts, with more than 5 million added just in the fourth quarter of 2012, the biggest bump in PayPal users in the company’s history.

Right now, eBay Inc (NASDAQ:EBAY) is positioned well for the continuing consumer transition into mobile e-commerce. Mobile transactions are growing fast for PayPal, but still account for just about 10% of its transactions. That leaves a lot of room for growth.

And regardless of whether they are executed on a mobile device or a desktop or laptop computer, eBay makes the same amount from its transactions. That’s an enviable position at a time when even Internet giants like Google Inc (NASDAQ:GOOG) are wrestling with the need to adapt to a mobile world that so far offers a less lucrative set of opportunities.

The risks

Despite being a less risky proposition than a high-flyer like Amazon.com, Inc. (NASDAQ:AMZN), eBay is not without its dangers. Looming large are payment systems that compete directly with PayPal.

There are plenty, from small, venture capital-funded startups like WePay and Boku, to more established e-payment solutions like GoogleWallet and Visa’s V.me, all looking to carve away a slice of PayPal’s pie.

And looming even larger, perhaps, is the prospect of a mobile payment system developed by Apple Inc. (NASDAQ:AAPL). With more than 500 million iTunes users already in Apple’s payment network, a digital wallet from Apple Inc. (NASDAQ:AAPL) could be a game changer for eBay Inc (NASDAQ:EBAY). According to recent reports, an Apple digital wallet is looking more likely, and it could happen as early as this year.

That’s a storyline eBay investors will want to keep a close eye on.

The bottom line

No longer the Internet auction house that grabbed our attention in the days of Web 1.0, eBay has transformed itself to again take a leading position in e-commerce with its popular and fast-growing services like PayPal and BillMeLater. That has eBay growing revenues and earnings quickly, and its brightest days may still lie ahead.

But for that to happen, eBay Inc (NASDAQ:EBAY) must fend off competition from upstarts as well as tech and financial heavyweights. Investors must keep watch for changes in that landscape.

John-Erik Koslosky owns shares of Apple. The Motley Fool recommends Amazon.com, Apple, and eBay. The Motley Fool owns shares of Amazon.com, Apple, and eBay.