Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Air Products & Chemicals, Inc. (NYSE:APD).

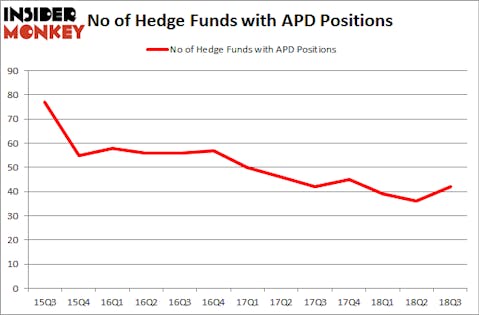

Is Air Products & Chemicals, Inc. (NYSE:APD) a first-rate stock to buy now? The smart money is turning bullish. The number of bullish hedge fund positions improved by 6 lately. Our calculations also showed that APD isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the recent hedge fund action surrounding Air Products & Chemicals, Inc. (NYSE:APD).

How are hedge funds trading Air Products & Chemicals, Inc. (NYSE:APD)?

Heading into the fourth quarter of 2018, a total of 42 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from the previous quarter. By comparison, 45 hedge funds held shares or bullish call options in APD heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Jonathan Barrett and Paul Segal’s Luminus Management has the number one position in Air Products & Chemicals, Inc. (NYSE:APD), worth close to $287.6 million, amounting to 5.8% of its total 13F portfolio. Coming in second is Samlyn Capital, led by Robert Pohly, holding a $107.5 million position; the fund has 2.4% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism contain John Overdeck and David Siegel’s Two Sigma Advisors, Brandon Haley’s Holocene Advisors and PVH’s D E Shaw.

As one would reasonably expect, some big names were breaking ground themselves. ThornTree Capital Partners, managed by Mark Moore, established the biggest position in Air Products & Chemicals, Inc. (NYSE:APD). ThornTree Capital Partners had $19.8 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also initiated a $9.5 million position during the quarter. The following funds were also among the new APD investors: Ilya Boroditsky’s Precision Path Capital, Louis Bacon’s Moore Global Investments, and Deepak Gulati’s Argentiere Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Air Products & Chemicals, Inc. (NYSE:APD) but similarly valued. These stocks are Edwards Lifesciences Corporation (NYSE:EW), BCE Inc. (NYSE:BCE), AFLAC Incorporated (NYSE:AFL), and Marathon Petroleum Corp (NYSE:MPC). This group of stocks’ market values resemble APD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EW | 29 | 706289 | 1 |

| BCE | 17 | 344957 | 1 |

| AFL | 29 | 922620 | 6 |

| MPC | 66 | 4796468 | 7 |

| Average | 35.25 | 1692584 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.70 billion. That figure was $1.33 billion in APD’s case. Marathon Petroleum Corp (NYSE:MPC) is the most popular stock in this table. On the other hand BCE Inc. (NYSE:BCE) is the least popular one with only 17 bullish hedge fund positions. Air Products & Chemicals, Inc. (NYSE:APD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MPC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.