We at Insider Monkey have gone over 866 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of Advance Auto Parts, Inc. (NYSE:AAP) based on that data.

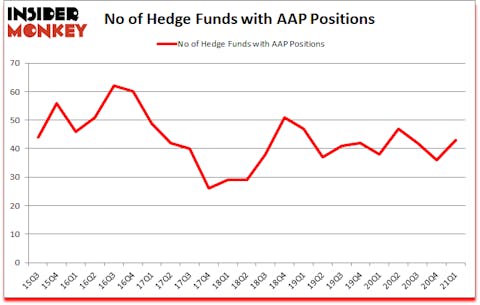

Is Advance Auto Parts, Inc. (NYSE:AAP) worth your attention right now? Money managers were in an optimistic mood. The number of bullish hedge fund positions moved up by 7 recently. Advance Auto Parts, Inc. (NYSE:AAP) was in 43 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 62. Our calculations also showed that AAP isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 206.8% since March 2017 and outperformed the S&P 500 ETFs by more than 115 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s take a look at the latest hedge fund action surrounding Advance Auto Parts, Inc. (NYSE:AAP).

Do Hedge Funds Think AAP Is A Good Stock To Buy Now?

At Q1’s end, a total of 43 of the hedge funds tracked by Insider Monkey were long this stock, a change of 19% from one quarter earlier. By comparison, 38 hedge funds held shares or bullish call options in AAP a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Gabriel Plotkin’s Melvin Capital Management has the biggest position in Advance Auto Parts, Inc. (NYSE:AAP), worth close to $234 million, corresponding to 1.3% of its total 13F portfolio. The second largest stake is held by Ken Griffin of Citadel Investment Group, with a $174.6 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Other members of the smart money that are bullish consist of Israel Englander’s Millennium Management, Ricky Sandler’s Eminence Capital and Alexander Mitchell’s Scopus Asset Management. In terms of the portfolio weights assigned to each position East Side Capital (RR Partners) allocated the biggest weight to Advance Auto Parts, Inc. (NYSE:AAP), around 8.23% of its 13F portfolio. Bronson Point Partners is also relatively very bullish on the stock, earmarking 7.02 percent of its 13F equity portfolio to AAP.

As industrywide interest jumped, key money managers have been driving this bullishness. Eminence Capital, managed by Ricky Sandler, assembled the biggest position in Advance Auto Parts, Inc. (NYSE:AAP). Eminence Capital had $152.9 million invested in the company at the end of the quarter. Steven Boyd’s Armistice Capital also initiated a $50.2 million position during the quarter. The other funds with brand new AAP positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Brad Stephens’s Six Columns Capital, and Ray Dalio’s Bridgewater Associates.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Advance Auto Parts, Inc. (NYSE:AAP) but similarly valued. We will take a look at AMERCO (NASDAQ:UHAL), Darling Ingredients Inc. (NYSE:DAR), Cree, Inc. (NASDAQ:CREE), The Mosaic Company (NYSE:MOS), Bill.com Holdings, Inc. (NYSE:BILL), Lincoln National Corporation (NYSE:LNC), and RPM International Inc. (NYSE:RPM). This group of stocks’ market valuations are similar to AAP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UHAL | 23 | 661125 | 2 |

| DAR | 33 | 756667 | -3 |

| CREE | 30 | 605496 | -3 |

| MOS | 38 | 944874 | -1 |

| BILL | 51 | 2411036 | -1 |

| LNC | 36 | 715298 | 0 |

| RPM | 20 | 79868 | -5 |

| Average | 33 | 882052 | -1.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $882 million. That figure was $1285 million in AAP’s case. Bill.com Holdings, Inc. (NYSE:BILL) is the most popular stock in this table. On the other hand RPM International Inc. (NYSE:RPM) is the least popular one with only 20 bullish hedge fund positions. Advance Auto Parts, Inc. (NYSE:AAP) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for AAP is 67.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and still beat the market by 6.1 percentage points. Hedge funds were also right about betting on AAP, though not to the same extent, as the stock returned 5.9% since Q1 (through June 18th) and outperformed the market as well.

Follow Advance Auto Parts Inc (NYSE:AAP)

Follow Advance Auto Parts Inc (NYSE:AAP)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 10 High Yield Dividend Stocks to Buy According to Billionaire David Harding

- 20 Short Dating Profile Examples for Males

Disclosure: None. This article was originally published at Insider Monkey.