Sohn Conference is my favorite hedge fund event. I haven’t missed an event since 2013. This doesn’t mean that every stock pitched at the conference is a great investment opportunity and will beat its benchmark. A few weeks ago we took a look at the performance of the stocks pitched at the 2018 Sohn Conference and found that these stocks outperformed their benchmarks by 3.2 percentage points.

We got pitched more than a dozen investment ideas in 2018. We didn’t tell our subscribers to invest equal amounts in each of those picks. Who does that anyway? A rational investor listens to all of these ideas, identifies a few promising ones, does his/her in-depth analysis, and then decides to pull the trigger on maybe 1 or 2 of these ideas. That’s what I did. One idea particularly stood at for me. I spent a few weeks analyzing that idea and decided to recommend it in our monthly newsletter. Our monthly newsletter tries to identify the “best stock picks of the best hedge fund managers”. We launched this strategy a little bit over 2 years ago and our stock picks managed to return 64% and beat the S&P 500 Index by nearly 40 percentage points.

How did we do it? By identifying the best stock picks of the best hedge fund managers. Guess which stock we recommended from the 2018 Sohn New York Conference? Ascendis Pharma (ASND). The stock was trading around $63 at time of Oleg Nodelman’s presentation. By the time I recommended it and our subscribers had time to buy the stock, the share price increased to $65. The stock’s price didn’t move much for several months.

I usually don’t give away my best stock idea but once a year we run a promotion and I give something valuable back to the subscribers who are powering Insider Monkey. Last October we published a free special issue of our monthly newsletter and send our 160,000 subscribers an email with the title “My #1 Top-Ranked Stock in the World”. You can still download the sample issue here.

My “#1 top-ranked stock” in October was Ascendis Pharma (ASND). It was trading at $63 at the time. Today, it is at $122. Investors who read our free report and bought the stock in the following few weeks returned more than 90% in 6 short months.

We are going share this year’s best investment idea again in the May 2019 issue of our monthly newsletter. If you subscribe to our monthly newsletter and aren’t satisfied with the performance of our stock pick, I will give your money back.

Below I am going to provide a complete recap of this year’s presentations. You can try to identify this year’s best idea by yourself or you can subscribe to our monthly newsletter and read a fully transcribed version of the presentation.

Next Wave: This is the part of the Sohn Conference where less known fund managers present their stock pitches. I usually like this portion of the Sohn Conference better because these “newer” fund managers try to build a name for themselves are more likely to present their absolute best ideas.

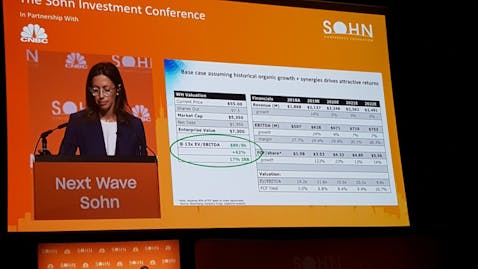

9:05 Lauren Taylor Wolfe, Managing Partner, Impactive Capital LP: Lauren Taylor Wolfe is the founder of Impactive Capital, an activist hedge fund with an ESG tilt. Previously she was Managing Director and Investing Partner at Clifton Robbins’ Blue Harbour Group. She focused on technology, consumer, business and healthcare services sectors at Blue Harbour. Before that, she cut her teeth at SIAR Capital focusing on small-cap stocks, private companies, and outside investment managers. Lauren Taylor Wolfe has an M.B.A. degree from The Wharton School at University of Pennsylvania and a B.S. from Cornell University.

Idea: Long position in Wyndham Hotels & Resorts (WH)

Benchmark: S&P 500 ETF (SPY)

Lauren Taylor Wolfe’s WH Thesis

Thesis: “Wyndham is a newly public $5 billion market cap company that’s the result of a spin merger that occurred nearly a year ago. Wyndham Hotels spun out of the time share company and just before completing the spin it acquired La Quinta Suites. La Quinta is a leading mid-scale hotel franchise company. You may be surprised to hear that Wyndham is now the largest hotel franchiser in the world with over 9000 franchise hotels in 80 countries and it enjoys 40% market share with the branded economy and mid-scale segment,” said Wolfe. Since WH is targeting the lower bottom (mostly economy and mid-scale) of the spectrum, its business is actually recession resistant. WH experienced 2% organic room growth during the 2008 financial crisis (impressive!). This segment of the market also experienced lower supply growth over the last 15 years according to Wolfe. The average room rate for this segment is also below $121 per day and Wolfe believes this mostly shields WH from online competition from the likes of Airbnb. Wolfe believes WH is a high quality company trading at a discount and she can add value through activism. Her base case scenario assumes historical growth rates plus synergies from the La Quinta merger driving the stock price all the way up to $89 in 3 years. She also thinks that Wyndham can double its EBITDA by taking on environmentally friendly cost saving initiatives. In this case she believes the stock price can exceed $110 in 3 years.

Background: In 2018 Sohn Idea Content winner talked about Wyndham and La Quinta. Please email meena@insidermonkey.com if you’d like a copy of this presentation.

You can read the summary of other presentations on the next page.

9:20 Todd Westhus, Founding Partner, Chief Investment Officer, Olympus Peak Asset Management LP: Todd Westhus is the founder and CIO of Olympus Peak Asset Management. Westhus was a managing partner at Perry Capital focusing on credit and special situations between 2006 and 2017. Before Perry Capital Westhus cut his teeth at Avenue Capital Group working on distressed opportunities in troubled industries such as airlines, automotive, chemicals, paper and packaging, and gaming. Todd has a B.A. in economics and biology from Duke University.

Idea: Short in unsecured Western Digital bonds hedged by a long position in senior secured bank debt. This isn’t a practical idea for ordinary investors. The underlying investment thesis relies on a deterioration in Western Digital’s financial condition. So, we will use a short position in WDC as a proxy to determine the success level of this thesis.

Benchmark: Short position in S&P 500 ETF.

Thesis: “Both cyclical and secular forces are working against the company. In our opinion the best to express this negative thesis towards Western Digital is not to outright short the equity but rather to have a long short position elsewhere in the capital structure. We are long senior secured bank debt ( trading for 99% of par) and short unsecured bonds (trading for 97% of par)” said Westhus. Basically Westhus is using a credit bet which has a maximum downside of 2% to bet that Western Digital shares will go down dramatically. This way if he is wrong his maximum loss would be only 2% whereas he can still generate double digit returns if WDC shares decline dramatically. Westhus believes Western Digital’s HDD business is under the threat of SSD. Half of Western Digital’s business is HDD and the other is SSD but they are a smaller player in the SSD market where prices have been collapsing over the last 5 quarters (they fell 25% last quarter alone). Inventory levels are at historically high levels and continue to increase. Westhus thinks we are about to see the effects of this on WDC shortly through even more declines in SSD prices which will shrink WDC’s gross profit margin to zero (currently it is at 21%). The fundamentals of the stock are moving in the opposite direction of WDC’s stock price and this can’t go on forever and sets up well for negative bet against the company which operates in a very volatile industry. WDC lost 50% of its SSD market share over the last 5 years, so competition is fierce in this segment. Westhus also said that Western Digital has the worst balance sheet in the industry and its cash balance is declining quickly (currently at 50% of its 2017 level). In short, Westhus believes Western Digital is managing a “melting ice cube business” and making expensive and unsuccessful acquisitions to counter this. To make the matters worse Westhus expects China to start investing heavily in this industry which means the future of this industry is bleak in terms of high prices and profit margins.

You can read the summary of other presentations on the next page.

9:35 Matthew J. Smith, Chief Executive Officer & Chief Investment Officer, Deep Basin Capital LP: In 2017 Matt Smith founded energy hedge fund Deep Basin Capital which employs a market and beta-neutral strategy. He previously worked at Citadel’s Surveyor Capital as a portfolio manager for more than 5 years. Prior to that, he cut his teeth as an energy analyst at Highfields Capital. He began his career at Copper Arch Capital before moving to JCK Partners. Matthew Smith holds a B.A. degree in Finance from University of Iowa and a Master’s of Science degree in Finance in the Applied Security Analysis Program (ASAP) at the University of Wisconsin. We recently started tracking Deep Basin Capital.

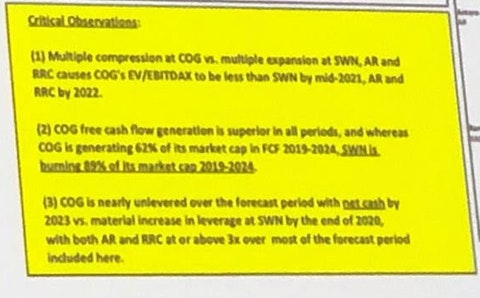

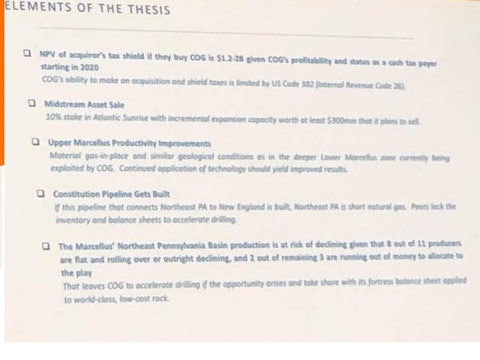

Idea: Long position in Cabot Oil & Gas Corporation (COG)

Benchmark: Long position in S&P 500 ETF

Thesis: “This business is a true unicorn in the energy sector and possesses an extraordinary combination of qualities. First, it is a single asset focus business with world class low cost unit level economics. Second, those economics fuel materially above peer margins that improve over time that do not degrade. Third, those margins yield abundant free cash flow so much so that over the next eight years the company will generate almost its entire market cap in free cash. In the mean time investors will get 9-10% free cash flow yield over each of the next 5 years on average. Fourth, contrary to the market perception this company is inexpensive on an absolute and relative basis. As a result, we believe this company is the prime takeout target in the entire E&P space with the management team incentivized to sell. The company is Cabot Oil & Gas (COG). The stock price is $25 a share. We get well into mid 30s on our base case using the forward commodity curve. Our upside case is in mid 40s if you breathe just a little bit of life into that natural gas curve to get to our bull case. That’s 60-80% upside versus the current stock price. Downside we think is very limited; we think it’s in the low 20s,” said Matthew Smith. “Many of Cabot’s peers are materially, structurally and terminally disadvantaged and, should Cabot not be acquired, we think in very short order, Cabot will be just one of very few natural gas E&Ps left standing,” Smith added.

Smith said that Cabot’s wells are 75% more productive than peers’ wells during the first 24 months giving it a huge cost advantage over peers.

You can read the summary of other presentations on the next page.

9:50 Parvinder Thiara, Chief Investment Officer, Athanor Capital, LP: Parvinder Thiara is the founder of Athanor Capital. Previously he worked at D. E. Shaw & Co for eight years. Parvinder Thiara holds a BA degree in Chemistry from Harvard College and an MSc degree in Theoretical Chemistry from Oxford University as a Rhodes Scholar.

Idea: Buy 2-year Brazilian bonds and short the Brazilian real

Benchmark: Long position in money market funds

Thesis: Parvinder Thiara is basically betting on a jump in the prices of Brazilian bonds. He thinks the market is priced in a bunch of interest rate hikes and bond prices are currently depressed as a result. He expects that Balsanaro will bully Brazil’s central bank into rate cuts which will lead to an increase in bond prices.

Since this trade isn’t practical to implement for retail investors, we will be excluding this pitch from our return calculations.

10:05 Angela Aldrich, Managing Partner & Portfolio Manager, Bayberry Capital Partners LP: Angela Aldrich is the founder of long/short equity hedge fund Bayberry Capital. Prior to launching her fund Aldrich spent more than 5 years at Blue Ridge Capital. Angela Aldrich received a BS degree in Economics from Duke University and an MBA from the Stanford Graduate School of Business.

Idea: Short Treasury Wine Estates (TSRYY)

Benchmark: Short position in iShares MSCI Australia ETF (EWA)

Thesis: Global wine market is a mature, slow and steady growth market. USA and China are the biggest regions in terms of wine consumption though Chinese consumption is growing much faster. The $10-$15 a bottle price segment had been growing fast in recent years and “this is really where Treasury has been killing it” said Angela Aldrich. This changed recently though.

Angela Aldrich said that Treasury Wine Estates is dealing with counterfeiters in China, cannibalizing its most popular brand. Aldrich also claims that Treasury Wine Estates was forcing its distributors to buy its other brands which aren’t well received by the Chinese consumers and the company is now looking at high inventory levels in China. The US wine market isn’t growing and Treasury has been stuffing every distribution channel recently and offering discounted wine at places like 7-Eleven, Costco, and Sam’s Club.

“So things are not good. We can see that things are not good. Management even sees that things are not good. With the revenue declines that we are seeing, the increased cost from in-house distribution, and generally negative operating leverage we see at least 50% downside with the stock,” said Aldrich.

We should note that Aldrich recommended shorting the Australian traded TWE-AU ticker, but we will be using the same company’s ADR to measure the performance of this stock pitch. TSRYY shares was trading at $11.49 on May 6th before Aldrich’s presentation and closed the day at $11.34. I thought it was a good presentation. I wouldn’t be surprised if this stock losses 20% of its value in the coming months.

You can read the summary of other presentations on the next page.

Main Conference

12:05 David Einhorn, President, Greenlight Capital, Inc.: David Einhorn’s main fund lost 34% in 2018, gained 1.6% in 2017 and 8.4% in 2016 and lost 20.2% in 2015. The fund also gained 8% in 2014 and 19.1% in 2013.

Idea: Short Tesla Inc (TSLA), Long AerCap Holdings (AER) and short GATX Corporation (GATX)

Benchmark: Short position in S&P 500 ETF for Tesla and GATX short recommendations, and long position in S&P 500 ETF for AER recommendation

Background and Thesis: AerCap Holdings isn’t a new position for David Einhorn or tons of other value investors. The stock was dirt cheap 5 years ago according to these value investors and it is dirt cheap now. Yet its stock price barely moved even after the company bought back 36% of its outstanding shares. Here is what David Einhorn said about AER in his 2015 Q1 investor letter:

“AerCap Holdings (AER) is the largest publicly traded aircraft leasing company. Last year, it bought AIG’s aircraft leasing business (ILFC) at a bargain price in an extremely accretive deal, taking AER’s total fleet from around 300 planes to more than 1,300. The combined business will benefit from AER’s lower tax rate and funding costs, as well as SG&A and operating efficiencies. The deal also provided AER with ILFC’s attractivelypriced order book of next-generation planes. We bought our position at an average price of $41.02, which is less than 8x this year’s expected earnings. AER’s management is well incentivized, with senior executives receiving new restricted stock units in the ILFC deal, two-thirds of which will vest only after hitting performance targets. The company has been well managed and appears poised to grow earnings at a double-digit clip for the next several years.”

Here is what Einhorn said about AER earlier this year in his 2018 Q4 investor letter:

“AER leases new and mid-life airplanes to airlines globally. AER’s 99%+ utilization rate and sevenyear average remaining lease term support a high degree of earnings visibility. The company is well-managed and a strong capital allocator. Since we invested in the company in 2014, AER has disposed of about 400 planes to improve its fleet age, technology mix and customer concentration, while generating strong gains on sale consistent with conservative carrying values. During this period, the company has de-levered, bought back 35% of its shares outstanding and grown book value per share by 15% annually. Global traffic growth has averaged 6.5% annually over the last five years. The recent collapse in oil prices is a positive as it improves airline profitability, further stimulates global passenger traffic, and supports the values of used planes. Nonetheless, shares of AER fell about 25% in December. At current values, we would expect management to accelerate the sale of aircraft to redeploy into an even more aggressive share repurchase program”

In his Sohn Conference presentation, Einhorn compared airplane leasing and rail cars leasing businesses and concluded that airplane leasing business is a growing business with earning visibility and no maintenance expenses whereas the rail car leasing business peaked in 2016 with limited earning visibility and GATX has to bear the maintenance expenses. Einhorn said both companies have similar market shares, similar balance sheets, similar funding costs, and similar return on assets.

“All else being equal we prefer AerCap. Better returns, better industry fundamentals, better looking too. Turns out you can buy AerCap at 50% discount to GATX. AerCap trades at half the book value multiple and less than half the PE. A better industry and a better company in that industry, we think the market has this wrong. And the discount is nothing new. AerCap has traded at low multiples for a long time. The persistent discounted value creates an opportunity for AerCap that GATX doesn’t have. Mainly the ability to buy back stock at a big discount. And this is what AerCap has done. Since 2015 AerCap has repurchased $3.7 billion of stock reducing shares outstanding by 36%. The result is that AerCap has grown its book value per share by 17.7% per year while GATX has grown its book value per share by 6.8% per year. In fairness, without as much opportunity to buy back cheap stock GATX has paid a dividend of about 4.5% of its book value per year. But even taking that into account AerCap has been the better performer and we expect more,” summarized Einhorn his investment thesis.

I get where Einhorn is coming from. However, here is my problem with value stocks such as AerCap or General Motors. These companies seem to trade at low multiples but they aren’t really growing their earnings per share despite substantial share buybacks. AerCap had an earnings per share of about $5.50 more than 4 years ago. If the company was able to “grow earnings at a double-digit clip for the next several years” as Einhorn expected, its expected earnings per share for 2020 would have been $13.80 after taking into account the 36% reduction in share count. Unfortunately analysts have a consensus eps estimate of only $6.76 for 2020. This tells us that AerCap’s total earnings have been shrinking by nearly 5% per year since 2015 and we see some moderate eps growth only because AER has been aggressively buying back shares.

The bottom line is that Einhorn was wrong about AerCap growing its earnings at a double-digit clip. AerCap’s earnings (not earnings per share) were behaving like melting ice cubes. I wouldn’t touch this stock with a 10 foot pole before I understand why its earnings have been going down and whether this can be reversed. Einhorn should have explained this in his presentation instead of talking about “secular growth rates” in the airline industry. If AER can’t grow its earnings in a growing industry, I don’t think the market will reward it with a higher PE multiple. On the other hand GATX looks to be slightly overvalued. Analysts still expect a small improvement in its earnings next year though. I don’t think GATX is a great short candidate. Finally Tesla Inc (TSLA) is a battleground stock. I don’t think it is a good investment for the next 12 months but I won’t short it either. Each of these stocks’ reaction to Einhorn’s presentation was muted. Einhorn used to move large-cap stocks by 5-10% when he talked about them at investment conferences; GATX shares lost less than 2% after Einhorn’s presentation.

You can read the summary of other presentations on the next page.

12:20 Ryan Heslop, Co-Founder & Portfolio Manager, Firefly Value Partners, LP: In 2006, Ryan Heslop co-founded the value focused long-short equity hedge fund Firefly Value Partners. Prior to Firefly, Ryan Heslop cut his teeth at Elm Ridge Capital Management, Fidelity Investments, and Putnam Investments. Ryan Heslop received a BA degree in Economics from Harvard University and an MBA from the Kellogg School of Management at Northwestern University. David Einhorn’s Greenlight Masters Fund is an investor in Firefly Value Partners.

Idea: Short Community Health Systems (CYH)

Benchmark: Short position in S&P 500 ETF

Thesis: Ryan Heslop thinks Community Health Systems will file for bankruptcy in the next few years and its equity will be worthless. According to Heslop CYH management’s compensation was based on revenue and EBITDA which led to a debt fueled acquisition spree where net debt grew from $2 billion to $16 billion. CYH is a rural hospital company and has been experiencing declining admissions, rising unit costs per bed, and declining profitability. Currently the company burns cash and the market believes the company will fail as its short ratio is above 41% of its float.

This would have been an impressive recommendation if Heslop pitched it 4 years ago when the stock was trading above $50 and hedge funds were tripping over each other to buy its shares. I remember Larry Robbins recommending this stock along with other hospital stocks at another investment conference. Currently the stock trades less than $3.50 and its market cap is below $400 million.

12:35 Laura Deming, Managing Director, Longevity Fund: Laura Deming is a venture capital fund manager investing in early stage companies that focus on therapies that could increase healthy human lifespan.

Idea: Long Precision BioSciences Inc (DTIL), ALX Oncology and Navitor Pharmaceuticals

Benchmark: Long position in S&P 500 ETF

Thesis: Pie in the sky. Research shows that certain worms and animals that went through certain gene mutations lived longer lives. An extension of this is that we may be able to extend human lifespan using gene editing technologies. If you are interested in this sort of stuff, you can check out Laura Deming’s website. Deming is invested in multiple early stage companies. DTIL is one of these companies that’s publicly traded.

I don’t think it is a good idea at all to initiate a long position in DTIL. I’d rather short this stock than go long. We cured cancer in animals 40 years ago, and yet we are still spending tens of billions of dollars in cancer research today.

You can read the summary of other presentations on the next page.

12:50 Dr. Joon Yun, President, Managing Member, Palo Alto Investors LP

1:05 Larry Robbins, Founder, Chief Executive Officer, Portfolio Manager, Glenview Capital Management, LLC

Please bookmark this article as I will be updating the article over the next 48 hours. You can also sign up below to receive our daily digest emails and get notified whenever we publish this type of content.

1:25 Intermission

2:10 Christopher R. Hansen, President and Founding Partner, Valiant Capital Management, L.P.

2:25 Fireside chat with Sir Michael Moritz, Partner, Sequoia Capital and Patrick Collison, Chief Executive Officer, Stripe

2:55 Bihua Chen, Founder and Portfolio Manager, Cormorant Asset Management, LP

3:10 Sohn Special Guests: Rick Lifton, M.D., Ph.D., The Rockefeller University and Evan Sohn, Co-Founder, Sohn Conference Foundation

3:20 Spencer Glendon, Concerned empiricist and Founder, Probable Futures

3:35 Intermission

4:20 The Sohn Idea Contest Presented by GLG

4:25 Sohn Idea Contest Winner

4:35 Fireside chat with Gabe Plotkin, Chief Investment Officer and Founder, Melvin Capital Management LP and Daniel Sundheim, Founder and Chief Investment Officer, D1 Capital Partners

5:05 Scott Goodwin, Managing Partner, Diameter Capital Partners LP

5:20 Jeffrey Gundlach, Chief Executive Officer, DoubleLine Capital LP