2018’s fourth quarter was a rough one for investors and many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 41.3% in 2019 and outperformed the S&P 500 ETF by more than 10 percentage points. In this article we will study how hedge fund sentiment towards Spirit Airlines Incorporated (NYSE:SAVE) changed during the third quarter and how the stock performed in comparison to hedge fund consensus stocks.

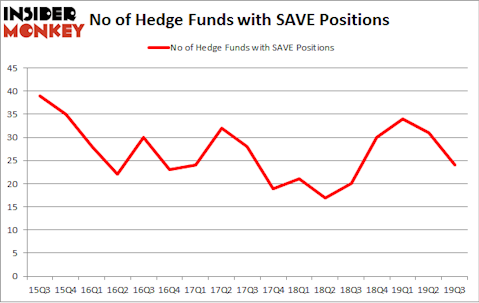

Spirit Airlines Incorporated (NYSE:SAVE) investors should pay attention to a decrease in hedge fund interest lately. SAVE was in 24 hedge funds’ portfolios at the end of the third quarter of 2019. There were 31 hedge funds in our database with SAVE positions at the end of the previous quarter. Our calculations also showed that SAVE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Chuck Royce of Royce & Associates

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind let’s review the key hedge fund action regarding Spirit Airlines Incorporated (NYSE:SAVE).

How have hedgies been trading Spirit Airlines Incorporated (NYSE:SAVE)?

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -23% from the second quarter of 2019. By comparison, 20 hedge funds held shares or bullish call options in SAVE a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, holds the biggest position in Spirit Airlines Incorporated (NYSE:SAVE). Polar Capital has a $35.5 million position in the stock, comprising 0.3% of its 13F portfolio. The second most bullish fund manager is Mountain Lake Investment Management, managed by Mitch Cantor, which holds a $18.2 million position; 9.2% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that are bullish consist of Michael Moriarty’s Teewinot Capital Advisers, Allan Mecham and Ben Raybould’s Arlington Value Capital and Chuck Royce’s Royce & Associates. In terms of the portfolio weights assigned to each position Mountain Lake Investment Management allocated the biggest weight to Spirit Airlines Incorporated (NYSE:SAVE), around 9.18% of its 13F portfolio. Teewinot Capital Advisers is also relatively very bullish on the stock, designating 6.17 percent of its 13F equity portfolio to SAVE.

Judging by the fact that Spirit Airlines Incorporated (NYSE:SAVE) has faced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of fund managers that elected to cut their full holdings by the end of the third quarter. It’s worth mentioning that Ross Margolies’s Stelliam Investment Management said goodbye to the largest position of the “upper crust” of funds followed by Insider Monkey, worth close to $21.2 million in stock. David Rosen’s fund, Rubric Capital Management, also sold off its stock, about $20.5 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 7 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Spirit Airlines Incorporated (NYSE:SAVE) but similarly valued. We will take a look at Cloudera, Inc. (NYSE:CLDR), Columbia Property Trust Inc (NYSE:CXP), CNO Financial Group Inc (NYSE:CNO), and Integer Holdings Corporation (NYSE:ITGR). This group of stocks’ market values resemble SAVE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CLDR | 26 | 652627 | 1 |

| CXP | 14 | 69448 | 2 |

| CNO | 16 | 194919 | 2 |

| ITGR | 16 | 173882 | -2 |

| Average | 18 | 272719 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $273 million. That figure was $183 million in SAVE’s case. Cloudera, Inc. (NYSE:CLDR) is the most popular stock in this table. On the other hand Columbia Property Trust Inc (NYSE:CXP) is the least popular one with only 14 bullish hedge fund positions. Spirit Airlines Incorporated (NYSE:SAVE) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately SAVE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SAVE were disappointed as the stock returned -30.4% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.