It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Total Return Index ETFs returned approximately 31% in 2019 (through December 23rd). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 41.1% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ consensus stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like L Brands Inc (NYSE:LB).

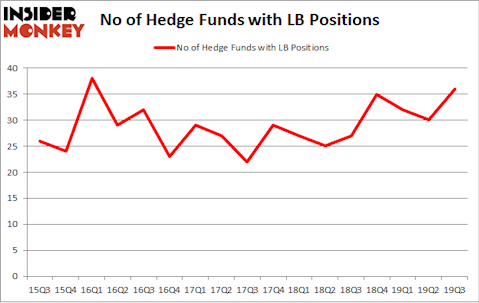

L Brands Inc (NYSE:LB) investors should be aware of an increase in support from the world’s most elite money managers of late. LB was in 36 hedge funds’ portfolios at the end of the third quarter of 2019. There were 30 hedge funds in our database with LB positions at the end of the previous quarter. Our calculations also showed that LB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Marc Lasry of Avenue Capital

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now we’re going to take a peek at the key hedge fund action surrounding L Brands Inc (NYSE:LB).

Hedge fund activity in L Brands Inc (NYSE:LB)

Heading into the fourth quarter of 2019, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 20% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards LB over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in L Brands Inc (NYSE:LB) was held by AQR Capital Management, which reported holding $71.7 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $69.6 million position. Other investors bullish on the company included Makaira Partners, Bridgewater Associates, and D E Shaw. In terms of the portfolio weights assigned to each position Barington Capital Group allocated the biggest weight to L Brands Inc (NYSE:LB), around 14.86% of its 13F portfolio. Okumus Fund Management is also relatively very bullish on the stock, earmarking 8.85 percent of its 13F equity portfolio to LB.

Consequently, key money managers were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the biggest position in L Brands Inc (NYSE:LB). Arrowstreet Capital had $22.2 million invested in the company at the end of the quarter. Steven Tananbaum’s GoldenTree Asset Management also made a $18.1 million investment in the stock during the quarter. The other funds with brand new LB positions are Lee Ainslie’s Maverick Capital, Steven Boyd’s Armistice Capital, and Marc Lasry’s Avenue Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as L Brands Inc (NYSE:LB) but similarly valued. These stocks are Tripadvisor Inc (NASDAQ:TRIP), Flex Ltd. (NASDAQ:FLEX), Leggett & Platt, Inc. (NYSE:LEG), and ITT Inc. (NYSE:ITT). This group of stocks’ market values are closest to LB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRIP | 29 | 1050535 | 3 |

| FLEX | 31 | 1478106 | -3 |

| LEG | 10 | 53164 | 1 |

| ITT | 20 | 516984 | -5 |

| Average | 22.5 | 774697 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $775 million. That figure was $542 million in LB’s case. Flex Ltd. (NASDAQ:FLEX) is the most popular stock in this table. On the other hand Leggett & Platt, Inc. (NYSE:LEG) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks L Brands Inc (NYSE:LB) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately LB wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on LB were disappointed as the stock returned -24.6% so far in 2019 (through 12/23) and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks already outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.