Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about GlaxoSmithKline plc (NYSE:GSK) and compare its performance to hedge funds’ consensus picks in 2019.

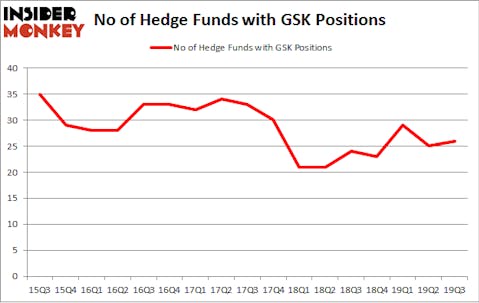

GlaxoSmithKline plc (NYSE:GSK) shareholders have witnessed an increase in hedge fund interest lately. GSK was in 26 hedge funds’ portfolios at the end of September. There were 25 hedge funds in our database with GSK positions at the end of the previous quarter. Our calculations also showed that GSK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

If you’d ask most traders, hedge funds are seen as underperforming, old financial tools of years past. While there are over 8000 funds trading at the moment, Our researchers choose to focus on the top tier of this club, around 750 funds. These hedge fund managers have their hands on most of the smart money’s total asset base, and by paying attention to their finest equity investments, Insider Monkey has unsheathed various investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Jim Simons of Renaissance Technologies

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now we’re going to take a look at the fresh hedge fund action regarding GlaxoSmithKline plc (NYSE:GSK).

What does smart money think about GlaxoSmithKline plc (NYSE:GSK)?

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from the second quarter of 2019. On the other hand, there were a total of 24 hedge funds with a bullish position in GSK a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, holds the most valuable position in GlaxoSmithKline plc (NYSE:GSK). Renaissance Technologies has a $749.1 million position in the stock, comprising 0.6% of its 13F portfolio. The second most bullish fund manager is Fisher Asset Management, managed by Ken Fisher, which holds a $651.6 million position; the fund has 0.7% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Kahn Brothers and John W. Rogers’s Ariel Investments. In terms of the portfolio weights assigned to each position Eversept Partners allocated the biggest weight to GlaxoSmithKline plc (NYSE:GSK), around 13.22% of its 13F portfolio. Kahn Brothers is also relatively very bullish on the stock, designating 8.67 percent of its 13F equity portfolio to GSK.

Consequently, key hedge funds were breaking ground themselves. Segantii Capital, managed by Simon Sadler, established the biggest position in GlaxoSmithKline plc (NYSE:GSK). Segantii Capital had $4.3 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace also initiated a $3.8 million position during the quarter. The other funds with new positions in the stock are Donald Sussman’s Paloma Partners, Ronald Hua’s Qtron Investments, and Matthew Tewksbury’s Stevens Capital Management.

Let’s also examine hedge fund activity in other stocks similar to GlaxoSmithKline plc (NYSE:GSK). We will take a look at Toronto-Dominion Bank (NYSE:TD), NVIDIA Corporation (NASDAQ:NVDA), Starbucks Corporation (NASDAQ:SBUX), and Linde plc (NYSE:LIN). This group of stocks’ market valuations are similar to GSK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TD | 15 | 295029 | -3 |

| NVDA | 48 | 1473439 | 3 |

| SBUX | 52 | 5593793 | 3 |

| LIN | 44 | 2523402 | 3 |

| Average | 39.75 | 2471416 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.75 hedge funds with bullish positions and the average amount invested in these stocks was $2471 million. That figure was $1891 million in GSK’s case. Starbucks Corporation (NASDAQ:SBUX) is the most popular stock in this table. On the other hand Toronto-Dominion Bank (NYSE:TD) is the least popular one with only 15 bullish hedge fund positions. GlaxoSmithKline plc (NYSE:GSK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately GSK wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); GSK investors were disappointed as the stock returned 29.2% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks already outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.