Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before 2018’s Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Ball Corporation (NYSE:BLL) changed recently.

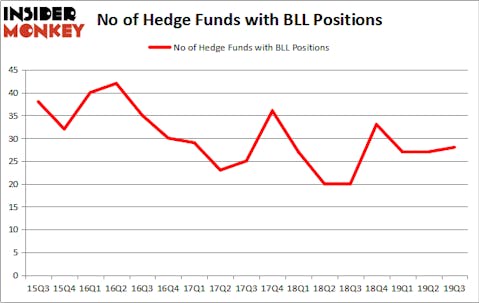

Ball Corporation (NYSE:BLL) has seen an increase in enthusiasm from smart money in recent months. BLL was in 28 hedge funds’ portfolios at the end of September. There were 27 hedge funds in our database with BLL positions at the end of the previous quarter. Our calculations also showed that BLL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Richard Chilton of Chilton Investment Company

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind let’s review the new hedge fund action surrounding Ball Corporation (NYSE:BLL).

What have hedge funds been doing with Ball Corporation (NYSE:BLL)?

Heading into the fourth quarter of 2019, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BLL over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chilton Investment Company, managed by Richard Chilton, holds the largest position in Ball Corporation (NYSE:BLL). Chilton Investment Company has a $219.2 million position in the stock, comprising 7.3% of its 13F portfolio. Coming in second is David Cohen and Harold Levy of Iridian Asset Management, with a $150.6 million position; 2.4% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that are bullish encompass John Overdeck and David Siegel’s Two Sigma Advisors, and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position Chilton Investment Company allocated the biggest weight to Ball Corporation (NYSE:BLL), around 7.32% of its 13F portfolio. Thames Capital Management is also relatively very bullish on the stock, dishing out 2.92 percent of its 13F equity portfolio to BLL.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Adage Capital Management, managed by Phill Gross and Robert Atchinson, established the most valuable position in Ball Corporation (NYSE:BLL). Adage Capital Management had $25.5 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $4.3 million position during the quarter. The other funds with new positions in the stock are Paul Tudor Jones’s Tudor Investment Corp, Matthew Tewksbury’s Stevens Capital Management, and Karim Abbadi and Edward McBride’s Centiva Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Ball Corporation (NYSE:BLL) but similarly valued. We will take a look at Baker Hughes, a GE company (NYSE:BHGE), Agilent Technologies Inc. (NYSE:A), IDEXX Laboratories, Inc. (NASDAQ:IDXX), and Hormel Foods Corporation (NYSE:HRL). This group of stocks’ market values resemble BLL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BHGE | 33 | 954876 | 15 |

| A | 37 | 1857520 | -2 |

| IDXX | 29 | 509187 | -8 |

| HRL | 19 | 190410 | 3 |

| Average | 29.5 | 877998 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $878 million. That figure was $556 million in BLL’s case. Agilent Technologies Inc. (NYSE:A) is the most popular stock in this table. On the other hand Hormel Foods Corporation (NYSE:HRL) is the least popular one with only 19 bullish hedge fund positions. Ball Corporation (NYSE:BLL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. A small number of hedge funds were also right about betting on BLL as the stock returned 41.8% in 2019 and outclassed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.