In this article we will check out the progression of hedge fund sentiment towards WideOpenWest, Inc. (NYSE:WOW) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

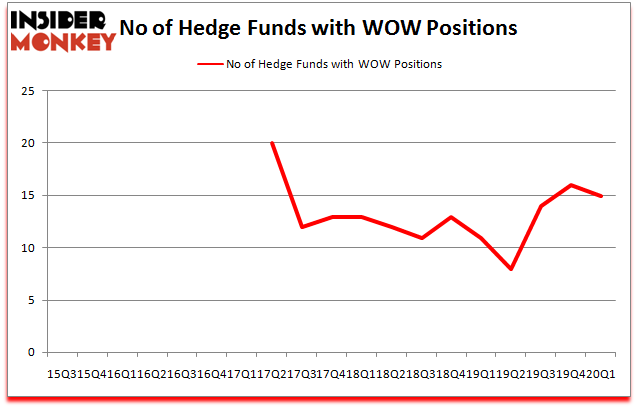

WideOpenWest, Inc. (NYSE:WOW) has experienced a decrease in hedge fund interest recently. WOW was in 15 hedge funds’ portfolios at the end of March. There were 16 hedge funds in our database with WOW positions at the end of the previous quarter. Our calculations also showed that WOW isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Mason Hawkins of Southeastern Asset Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, blockchain technology’s influence will go beyond online payments. So, we are checking out this futurist’s moonshot opportunities in tech stocks. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to take a gander at the fresh hedge fund action surrounding WideOpenWest, Inc. (NYSE:WOW).

What does smart money think about WideOpenWest, Inc. (NYSE:WOW)?

Heading into the second quarter of 2020, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the previous quarter. By comparison, 11 hedge funds held shares or bullish call options in WOW a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Indaba Capital Management was the largest shareholder of WideOpenWest, Inc. (NYSE:WOW), with a stake worth $5.5 million reported as of the end of September. Trailing Indaba Capital Management was Arrowstreet Capital, which amassed a stake valued at $3.7 million. Southeastern Asset Management, GAMCO Investors, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Indaba Capital Management allocated the biggest weight to WideOpenWest, Inc. (NYSE:WOW), around 2.95% of its 13F portfolio. Zebra Capital Management is also relatively very bullish on the stock, earmarking 0.51 percent of its 13F equity portfolio to WOW.

Due to the fact that WideOpenWest, Inc. (NYSE:WOW) has faced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of hedgies that slashed their positions entirely by the end of the first quarter. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP said goodbye to the biggest stake of all the hedgies followed by Insider Monkey, worth about $2.4 million in stock, and Matthew Drapkin and Steven R. Becker’s Becker Drapkin Management was right behind this move, as the fund cut about $1.2 million worth. These transactions are intriguing to say the least, as total hedge fund interest fell by 1 funds by the end of the first quarter.

Let’s also examine hedge fund activity in other stocks similar to WideOpenWest, Inc. (NYSE:WOW). We will take a look at U.S. Lime & Minerals Inc. (NASDAQ:USLM), Calix Inc (NYSE:CALX), International General Insurance Holdings Ltd. (NASDAQ:IGIC), and Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY). This group of stocks’ market valuations resemble WOW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| USLM | 3 | 26406 | -1 |

| CALX | 15 | 80773 | 1 |

| IGIC | 10 | 12057 | -1 |

| PLAY | 12 | 75188 | -7 |

| Average | 10 | 48606 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $49 million. That figure was $20 million in WOW’s case. Calix Inc (NYSE:CALX) is the most popular stock in this table. On the other hand U.S. Lime & Minerals Inc. (NASDAQ:USLM) is the least popular one with only 3 bullish hedge fund positions. WideOpenWest, Inc. (NYSE:WOW) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.3% in 2020 through June 25th but still beat the market by 16.8 percentage points. Hedge funds were also right about betting on WOW as the stock returned 26.9% in Q2 (through June 25th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Wideopenwest Inc. (NYSE:WOW)

Follow Wideopenwest Inc. (NYSE:WOW)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.