The S&P 500 has yet to reach its levels from March 2008, but Visa Inc (NYSE:V) is up 117% from its IPO at that time including a 35% gain year to date. Visa also topped our list of the most popular services stocks among hedge funds for the second quarter of 2012 (see the full rankings) as 67 funds and other notable investors in our database of 13F filings reported a position in the stock. Two of these funds, which in fact increased their stakes during the quarter, are run by “Tiger Cubs”, former employees of Julian Robertson at Tiger Management (Robertson, in an interview about a year ago, had urged investors to buy credit card companies). Tiger Global Management, which is run by billionaire Chase Coleman and his team, owned 3 million shares (research more stocks that Tiger Global owns) while Andreas Halvorsen’s Viking Global moved heavily into the stock and closed June with 4.9 million shares in its portfolio (find more stock picks from Viking Global).

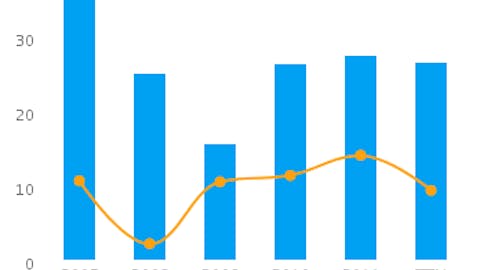

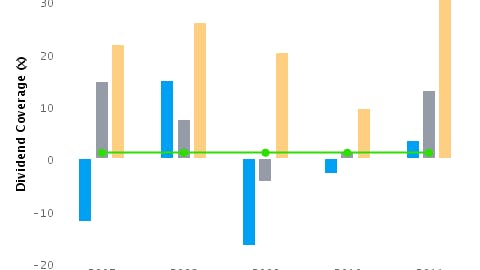

The third quarter of Visa’s fiscal year ended in June with the company reporting a 10% increase in revenue compared to the third fiscal quarter of last year. This was actually a lower growth rate than what the company had been doing on the top line; revenue for the first nine months of the fiscal year was 13% higher than a year earlier. Visa took a large litigation charge during the quarter, which pulled operating income negative. Without that charge, operating income was up 11%, so the company is doing well at preserving margins as well as at growing its core business. Visa has also used less cash to buy back shares this fiscal year than it did last year, though this is reasonable given the increase in the share price since that time. While we think Visa should be able to continue its growth, we are wary of its forward P/E of 19- it is possible that the stock price is due for a correction.

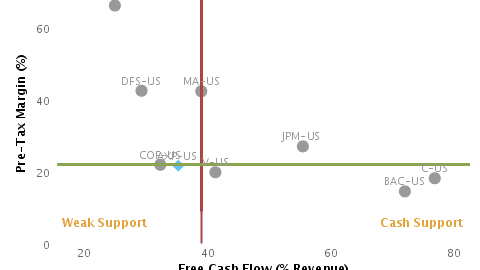

The best peers for Visa are fellow credit card companies Mastercard Inc (NYSE:MA), Discover Financial Services (NYSE:DFS), American Express Company (NYSE:AXP), and Capital One Financial Corp. (NYSE:COF). Mastercard is probably the closest peer, and it trades at a similar valuation to Visa at 18 times forward earnings estimates. It also saw growth last quarter, with its revenue increasing 9% and its earnings increasing 15%. We think that Visa has a slightly better brand than Mastercard, and so should be trading at a slightly higher multiple given that its recent business performance has been about the same. That is exactly what we see, so we don’t think either of the two is overpriced relative to the other.

Visa and Mastercard are much more expensive than the other three companies, however. Discover, American Express, and Capital One carry forward P/Es of 10, 12, and 8, respectively. True, it can be argued that their brands are not as good as the market leaders- though followers of American Express would take exception to that- but that is a quite wide gap in valuation. In Capital One’s case, revenue and earnings are down from a year ago so it does make sense for the stock to be trading at a substantial discount. We would rather avoid it, but would note that it would be an excellent value if analyst expectations prove correct. American Express’s business has been about flat, and we think it is a better buy than Mastercard or Visa when taking into account its low multiples (its trailing P/E is only 14 as well). Discover appears to be even more undervalued. It trades at 10 times forward earnings estimates, as we’ve mentioned, and 9 times trailing earnings even after the 64% gain in the stock price from a year ago. This is because its business has been doing very well: its most recent quarterly report showed revenue up 30% and earnings up 36% from the same period in the previous year.

Visa seems about even with Mastercard, with the two likely not warranting such a high premium relative to other companies in the credit card industry. American Express appears to be a better value, and Discover would certainly be worth a closer look as well.