Back on track

The company really messed up during the credit bubble. American International Group Inc (NYSE:AIG) was insuring banks and other investors against potential losses in subprime real estate assets, which was probably the worst kind of bet it could possibly make at the time.

When the crisis exploded, American International Group Inc (NYSE:AIG) found itself in a position of insolvency, so the company was declared “too big to fail” and received a $182 billion bailout from the federal government in order to backstop a crisis that was producing ripple effects all over the global financial system.

But that´s ancient history, and under the leadership of Robert Benmosche the company has gone through a long and painful restructuring process, including big reductions in its workforce and the sale of valuable assets like its Asian life insurance business. Perhaps more important, AIG has now liquidated 93% of the complex derivatives it had in its balance sheet at the end of 2008.

American International Group Inc (NYSE:AIG) has completely repaid the government, so the company is free to focus its energy and financial resources in reigniting growth and profitability, and it seems to be moving in the right direction judging by financial results.

The company reported earnings figures well above analysts’ expectations for the last quarter: overall insurance operating income was up 28% from the same quarter last year, and book value per share, excluding accumulated other comprehensive income (AOCI), increased by 12% in comparison to the first quarter of 2012.

Attractive valuation

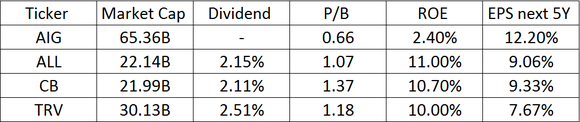

In spite of this noteworthy recovery, American International Group Inc (NYSE:AIG) is trading well below average valuation levels for the industry. When comparing price to book value ratios for AIG versus other insurance companies like The Allstate Corporation (NYSE:ALL), The Chubb Corporation (NYSE:CB) and Travelers Companies Inc (NYSE:TRV), the company is looking deeply undervalued. AIG has a price to book value ratio of 0.66, while is competitors are in the range of 1.07 to 1.37.

One possible explanation for this undervaluation may be that investors are not yet giving the company the credit it deserves for its improved financial position; however, we still need to consider that AIG has much lower profitability than its competitors.

When looking at return on equity – ROE – ratios, AIG´s profitability is clearly below that of its peers: it’s in the area of 2.4% versus levels in the range of 10% to 11% for other companies in the business. The higher the ROE, the more profitable each dollar of equity, hence the price to book value ratio should be higher. With lower profitability, American International Group Inc (NYSE:AIG) may actually deserve a lower price to book value ratio.

But here comes good news for AIG investors: management has stated its goal of reaching a 10% ROE in the middle term, and they seem to be making progress in that area. If – or when – AIG gets its profitability rations in line with that of its competitors, investors should enjoy some big fat returns as the company´s valuation multiples expand to average industry levels.

Improving industry conditions

AIG benefited from improving pricing conditions in the last quarter, and other companies are confirming the trend towards better times for insurance underwriters in the middle term.