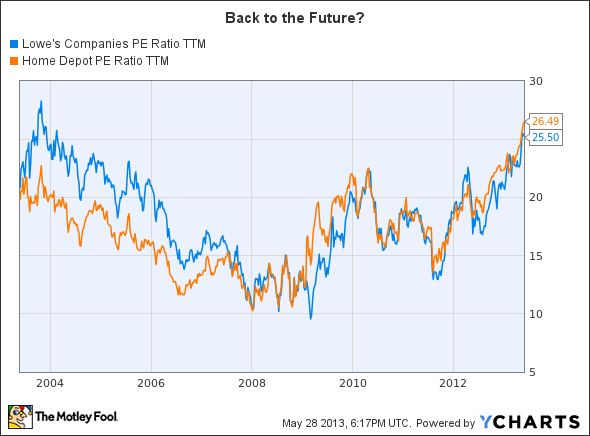

My only concern here is that these stocks have come a long way, and now most investors will have somewhat priced in a housing recovery. A look at their evaluations suggests that they are at levels above what they were when the housing industry entered a recession in 2006.

LOW PE Ratio TTM data by YCharts

Frankly I think that momentum and ongoing positive news on housing is going to take these stocks higher. However, investing is about trying to find the optimal ways to generate returns from your views. With this in mind I think it is time to look beyond the evaluations at the home improvement stores and look at some of the wider housing and construction plays.

Two housing and construction plays

Housing recoveries usually predate construction related improvements. New housing projects get developed which leads to new commercial construction. In this regard I think Whirlpool Corporation (NYSE:WHR) and Stanley Black & Decker, Inc. (NYSE:SWK). The interesting thing about Whirlpool is that it offers upside from its push to increase margins. Given that home improvement stores are reporting good numbers it is reasonable to expect that Whirlpool will see a strong spring too. Moreover, we are hitting the 10 year anniversary of the peak of the housing boom so the replacement cycle should start to kick in soon as well. The stock trades on a forward PE of 13.3x and traditionally generates large cash flows.

Turning to Stanley Black & Decker, Inc. (NYSE:SWK), this stock has upside potential from a housing recovery and a strategic growth initiative with which it intends to generate growth via expanding in selected verticals while benefiting from ongoing merger synergies.

Its recent results were a bit disappointing, but like Whirlpool Corporation (NYSE:WHR) it was affected by some temporary weakness in Latin America (both companies argued that it will rectify in future quarters) and from the weather effects of a late spring. At the time of both these companies results I was slightly skeptical over the weather argument but now that The Home Depot, Inc. (NYSE:HD) and Lowe’s Companies, Inc. (NYSE:LOW) have confirmed its effect and, more importantly, argued strongly that growth will come back.I think this is a good sign for Stanley Black & Decker. Moreover the stock trades on trades on a forward PE ratio of 14.6x and is forecasting $1 billion in free cash flow this year.

Lee Samaha has no position in any stocks mentioned. The Motley Fool recommends Home Depot and Lowe’s. Lee is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

The article Finding Value in the Housing Sector originally appeared on Fool.com and is written by Lee Samaha.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.