There were 659 hedge funds in our database, whose 13F portfolios on June 30 contained at least five long positions in billion-dollar companies. Of those 659 funds, an impressive 627 of them delivered positive returns during the third quarter, according to our calculations. All told, their long picks in billion-dollar companies averaged a gain of 8.3% for the quarter, well above the S&P 500 ETFs’ 3.3% figure.

Nonetheless, hedge funds continue to disappoint their investors for the most part, as redemptions have hit the industry hard of late. That can be chalked up to their high fees and the underperformance on the short-side of their portfolios, which provide downside protection but have dragged down overall returns. We recommend investors consider hedge funds’ long stock picks for their market-beating potential and will share four of them in this article, which were in the portfolio of Christopher Lyle‘s SCGE Management on June 30.

Christopher Lyle’s SCGE Management is a privately owned California- based hedge fund, founded in 2008. It offers its professional services to pooled investment vehicles. The firm reported an equity portfolio worth $323.26 million as of the end of June. Out of 13 relevant positions held by SCGE Management in companies valued at $1 billion or more on June 30, the fund’s holdings delivered a weighted average return of 14.11% during the third quarter. It should be noted that our calculations may be different from the fund’s actual returns, as they do not factor in changes made to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions.

In this article, we’ll take a look at four of the favorite stock picks of SCGE Management and see how they performed during the third quarter.

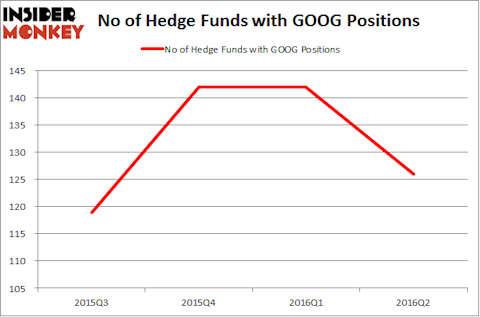

Let’s start with Alphabet Inc (NASDAQ:GOOG), in which SCGE Management disclosed owning 50,000 class C shares of the company, which have been valued at $34.61 million. The fund boosted its stake in the company during the second quarter, having acquired 38,017 shares. The stock returned 12.3% during the third quarter. Out of the nearly 750 hedge funds followed by Insider Monkey, 126 reported long positions in the company heading into the third quarter. The biggest investor in Alphabet Inc (NASDAQ:GOOG) at the time, was Eagle Capital Management, which reported holding a stake valued at $1.28 billion. Remaining investors with a similar optimism included Southeastern Asset Management, Egerton Capital Limited, Lone Pine Capital, and Viking Global.

Follow Alphabet Inc. (NASDAQ:GOOG)

Follow Alphabet Inc. (NASDAQ:GOOG)

Receive real-time insider trading and news alerts

SCGE Management held 175,000 shares of LinkedIn Corp (NYSE:LNKD) valued at $33.12 million at the end of June. The stock inched up by 1% during the third quarter. A total of 66 funds tracked by Insider Monkey held long positions in this stock at the end of June, a change of 61% from one quarter earlier. More specifically, SRS Investment Management was the largest shareholder of LinkedIn Corp (NYSE:LNKD), with a stake worth $504.5 million reported as of the end of June. Trailing SRS Investment Management was Pentwater Capital Management, which amassed a stake valued at $492.3 million. Arrowgrass Capital Partners, Farallon Capital, and D E Shaw also held valuable positions in the company.

Follow Linkedin Corp (NYSE:LNKD)

Follow Linkedin Corp (NYSE:LNKD)

Receive real-time insider trading and news alerts

On the next page, we will continue our discussion of SCGE Management’s greatest bets of third quarter.

Let’s take a look at SCGE Management’s ownership in Facebook Inc (NASDAQ:FB). The fund reported holding 275,000 shares worth $31.43 million as of the end of June, and it saw the stock gain 12.2% in the following three months. Overall, Facebook was included in the equity portfolios of 148 funds from our database, down from 164 funds a quarter earlier. Among these investors, the number one position in the company was reported by Andreas Halvorsen’s Viking Global, which was worth close to $2.30 billion. On Viking Global’s heels was Lone Pine Capital, led by Stephen Mandel, holding a $1.25 billion position. Other peers that held long positions encompassed Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, John Armitage’s Egerton Capital Limited, and Alex Snow’s Lansdowne Partners.

Follow Meta Platforms Inc. (NASDAQ:META)

Follow Meta Platforms Inc. (NASDAQ:META)

Receive real-time insider trading and news alerts

And now, last but not least, Workday Inc (NYSE:WDAY), a provider of enterprise cloud applications for human resources and finance, saw SCGE Management cut its stake by 800,000 shares to 400,000 shares worth $29.87 million at the end of June. The stock surged by 22.8% during the third quarter. A total of 25 funds tracked by Insider Monkey were bullish on this stock heading into the third quarter. The largest stake in Workday Inc (NYSE:WDAY) was held by Matrix Capital Management, which reported holding $381.6 million worth of stock at the end of June. It was followed by Tybourne Capital Management with a $205.2 million position. Other investors bullish on the company included Criterion Capital, Citadel Investment Group, and SRS Investment Management.

Follow Workday Inc. (NASDAQ:WDAY)

Follow Workday Inc. (NASDAQ:WDAY)

Receive real-time insider trading and news alerts

Disclosure: None