Next up is Interval Leisure Group, Inc. (NASDAQ:ILG), a provider of non-traditional lodging and other vacation services. Bart Baum and his team decided to reduce their fund’s exposure to this stock, trimming their position in it by roughly 1%. At the end of September, Ionic Capital held 805,633 shares of the company worth approximately $13.8 million. After a solid advance in July, Interval Leisure Group, Inc. (NASDAQ:ILG) stock suffered a correction in August and September, but was still up by 8.7% for the quarter at the end of September.

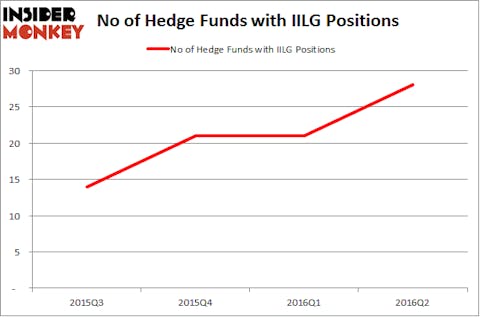

At the end of June, Interval Leisure Group, Inc. (NASDAQ:ILG) could be found in the portfolios of 28 of the hedge funds followed by Insider Monkey, up from 21 hedge funds registered at the end of the previous quarter. When looking at the institutional investors followed by Insider Monkey, Wallace Weitz’s Wallace R. Weitz & Co. had the most valuable position in Interval Leisure Group, worth close to $61.4 million. Coming in second was Boykin Curry of Eagle Capital Management, with a $44.1 million position. Other peers that held long positions were Steve Cohen’s Point72 Asset Management, Howard Guberman’s Gruss Asset Management, and Joel Greenblatt’s Gotham Asset Management.

Follow Ilg Llc (NASDAQ:ILG)

Follow Ilg Llc (NASDAQ:ILG)

Receive real-time insider trading and news alerts

The last stock in this group is Aramark (NYSE:ARMK), a provider of food, facilities and uniform services to clients from various industries. Ionic Capital’s management team has continued to dump the stock, slashing its stake by 22% during the third quarter. According to its latest 13F filing, the fund held 289,908 shares at the end of September, valued at a little over $11 million. Aramark (NYSE:ARMK) ended the third quarter on a high note, having posted a positive return of 14.1%.

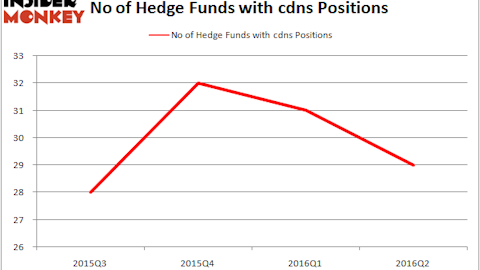

Hedge fund sentiment towards Aramark took a turn for the worse in the second quarter. At the end of June, 33 of the funds tracked by Insider Monkey reported having a stake in the company, down from 44 registered three months earlier. Among those that held on to their positions, Kensico Capital was the largest shareholder of Aramark (NYSE:ARMK), with a stake worth $287.2 million reported as of the end of June. Trailing Kensico Capital was Samlyn Capital, which amassed a stake valued at $233.2 million. Maverick Capital, D E Shaw, and Suvretta Capital Management also held valuable positions in the company.

Follow Aramark (NYSE:ARMK)

Follow Aramark (NYSE:ARMK)

Receive real-time insider trading and news alerts

Disclosure: None