Bart Baum started Ionic Capital Management in 2006 together with Dan Stone and Adam Radosti. All three had previously worked at Glenn Russell Dubin‘s Highbridge Capital Management. Ionic Capital invests in public equity, fixed income and alternative investment markets worldwide, and had roughly $5.82 billion in assets under management at the end of August 2016. According to its latest 13F filing, the fund managed a $2.26 billion equity portfolio at the end of the third quarter, with significant exposure to the financial sector, which accounted for 58% of the portfolio’s value.

At Insider Monkey we have developed our own measurement for a fund manager’s ability to pick stocks. We measure the performance of all equity bets on companies with a market cap of $1 billion and up. Under these assumptions, Ionic Capital Management managed a weighted average return of 11.37% in the third quarter, from 107 qualifying positions. With that in mind, we’ll take a look at four major equity bets held by the fund in Tyson Foods, Inc.(NYSE:TSN), Allergan Inc.(NYSE:AGN), Interval Leisure Group, Inc. (NASDAQ:ILG) and Aramark (NYSE:ARMK), and see how they were adjusted heading into the fourth quarter.

After a major bullish move in the second quarter, Ionic Capital made a U-turn with regard to Tyson Foods, Inc. (NYSE:TSN), having dumped 97% of the fund’s stake in the company. According to regulatory filings, Ionic Capital held 15,314 Tyson Foods shares worth approximately $1.25 million at the end of September. After a solid first six months of the year, Tyson Foods, Inc. (NYSE:TSN) continued to climb higher in the third quarter, registering a positive return of 12% for the period, which may have prompted the fund to move to something it viewed as more undervalued.

At the end of the second quarter, a total of 40 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the first quarter of 2016. Among these funds, Iridian Asset Management held the most valuable stake in Tyson Foods, Inc. (NYSE:TSN), which was worth $479.7 million at the end of the second quarter. On the second spot was AQR Capital Management which amassed $460.5 million worth of shares. Moreover, First Eagle Investment Management, D E Shaw, and Arrowstreet Capital were also bullish on Tyson Foods.

Follow Tyson Foods Inc. (NYSE:TSN)

Follow Tyson Foods Inc. (NYSE:TSN)

Receive real-time insider trading and news alerts

Ionic Capital Management’s stake in pharma giant Allergan, Inc. (NYSE:AGN) was cut by approximately 9% during the third quarter. In its latest 13F filing, the fund indicated ownership of 56,120 shares worth $12.9 million at the end of September. The third quarter was a disappointing one for Allergan, Inc. (NYSE:AGN) shareholders, as the stock inched down by 0.3% for the period.

The popularity of the stock among the funds followed by Insider Monkey plummeted during the second quarter, as the number of funds invested in it fell by 23% to 131 at the end of June. The largest stake in Allergan, Inc. (NYSE:AGN) among them was held by Third Point, which reported holding $1.13 billion worth of stock as of the end of June. It was followed by Paulson & Co with a $912.4 million position. Other investors bullish on the company included Icahn Capital LP and Elliott Management.

Follow Allergan Inc (NYSE:AGN)

Follow Allergan Inc (NYSE:AGN)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

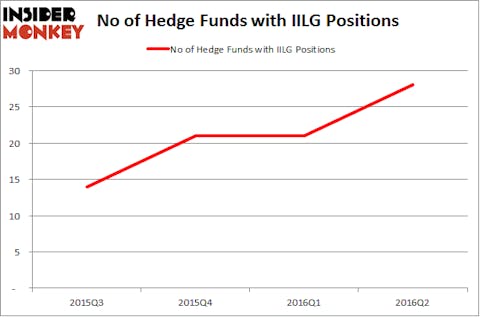

Next up is Interval Leisure Group, Inc. (NASDAQ:ILG), a provider of non-traditional lodging and other vacation services. Bart Baum and his team decided to reduce their fund’s exposure to this stock, trimming their position in it by roughly 1%. At the end of September, Ionic Capital held 805,633 shares of the company worth approximately $13.8 million. After a solid advance in July, Interval Leisure Group, Inc. (NASDAQ:ILG) stock suffered a correction in August and September, but was still up by 8.7% for the quarter at the end of September.

At the end of June, Interval Leisure Group, Inc. (NASDAQ:ILG) could be found in the portfolios of 28 of the hedge funds followed by Insider Monkey, up from 21 hedge funds registered at the end of the previous quarter. When looking at the institutional investors followed by Insider Monkey, Wallace Weitz’s Wallace R. Weitz & Co. had the most valuable position in Interval Leisure Group, worth close to $61.4 million. Coming in second was Boykin Curry of Eagle Capital Management, with a $44.1 million position. Other peers that held long positions were Steve Cohen’s Point72 Asset Management, Howard Guberman’s Gruss Asset Management, and Joel Greenblatt’s Gotham Asset Management.

Follow Ilg Llc (NASDAQ:ILG)

Follow Ilg Llc (NASDAQ:ILG)

Receive real-time insider trading and news alerts

The last stock in this group is Aramark (NYSE:ARMK), a provider of food, facilities and uniform services to clients from various industries. Ionic Capital’s management team has continued to dump the stock, slashing its stake by 22% during the third quarter. According to its latest 13F filing, the fund held 289,908 shares at the end of September, valued at a little over $11 million. Aramark (NYSE:ARMK) ended the third quarter on a high note, having posted a positive return of 14.1%.

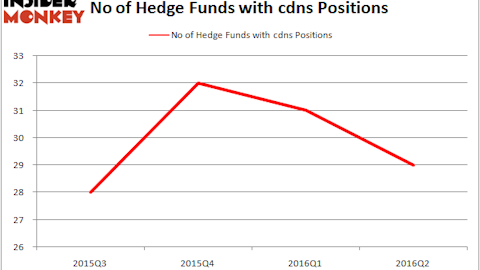

Hedge fund sentiment towards Aramark took a turn for the worse in the second quarter. At the end of June, 33 of the funds tracked by Insider Monkey reported having a stake in the company, down from 44 registered three months earlier. Among those that held on to their positions, Kensico Capital was the largest shareholder of Aramark (NYSE:ARMK), with a stake worth $287.2 million reported as of the end of June. Trailing Kensico Capital was Samlyn Capital, which amassed a stake valued at $233.2 million. Maverick Capital, D E Shaw, and Suvretta Capital Management also held valuable positions in the company.

Follow Aramark (NYSE:ARMK)

Follow Aramark (NYSE:ARMK)

Receive real-time insider trading and news alerts

Disclosure: None