We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in Q3, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards EnLink Midstream Partners LP (NYSE:ENLK).

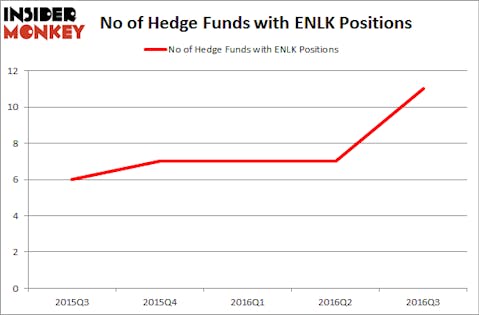

EnLink Midstream Partners LP (NYSE:ENLK) has experienced an increase in activity from the world’s largest hedge funds recently. ENLK was in 11 hedge funds’ portfolios at the end of September. There were 7 hedge funds in our database with ENLK positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as KAR Auction Services Inc (NYSE:KAR), Arista Networks Inc (NYSE:ANET), and TIM Participacoes SA (ADR) (NYSE:TSU) to gather more data points.

Follow Enlink Midstream Partners Lp (NYSE:ENLC)

Follow Enlink Midstream Partners Lp (NYSE:ENLC)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Zorandim/Shutterstock.com

How have hedgies been trading EnLink Midstream Partners LP (NYSE:ENLK)?

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, up by 57% from the second quarter of 2016. By comparison, 7 hedge funds held shares or bullish call options in ENLK heading into this year. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Alec Litowitz and Ross Laser’s Magnetar Capital has the biggest position in EnLink Midstream Partners LP (NYSE:ENLK), worth close to $93.4 million, corresponding to 1.4% of its total 13F portfolio. Coming in second is Balyasny Asset Management, led by Dmitry Balyasny, holding a $12.8 million position. Some other members of the smart money that hold long positions include Charles Davidson’s Wexford Capital, and Jim Simons’ Renaissance Technologies, one of the largest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, some big names were breaking ground themselves. Driehaus Capital also made a $2.6 million investment in the stock during the quarter. The following funds were also among the new ENLK investors: Israel Englander’s Millennium Management, Matthew Hulsizer’s PEAK6 Capital Management, and Vishal Bhutani and Joshua Bederman’s Pyrrho Capital Management.

Let’s go over hedge fund activity in other stocks similar to EnLink Midstream Partners LP (NYSE:ENLK). These stocks are KAR Auction Services Inc (NYSE:KAR), Arista Networks Inc (NYSE:ANET), TIM Participacoes SA (ADR) (NYSE:TSU), and Liberty Property Trust (NYSE:LPT). This group of stocks’ market caps are closest to ENLK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KAR | 35 | 910965 | -1 |

| ANET | 17 | 225054 | 0 |

| TSU | 13 | 327137 | -3 |

| LPT | 14 | 77164 | -1 |

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $385 million. That figure was $128 million in ENLK’s case. KAR Auction Services Inc (NYSE:KAR) is the most popular stock in this table. On the other hand TIM Participacoes SA (ADR) (NYSE:TSU) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks EnLink Midstream Partners LP (NYSE:ENLK) is even less popular than TSU. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

Countries With The Best Healthcare

Easiest Decades To Dress Up As

Fastest Growing Cities In India

Disclosure: None