Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards Prologis Inc (NYSE:PLD).

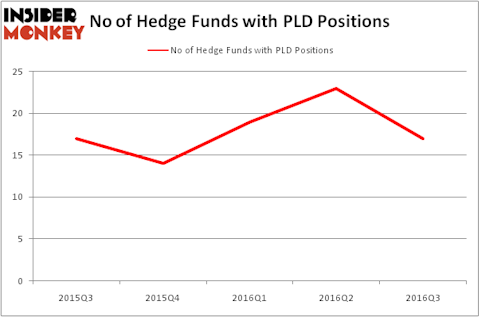

Prologis Inc (NYSE:PLD) has seen a decrease in hedge fund interest in recent months. There were 23 hedge funds in our database with PLD holdings at the end of the second quarter, six more than at the end of the third quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as V.F. Corporation (NYSE:VFC), PPL Corporation (NYSE:PPL), and Deere & Company (NYSE:DE) to gather more data points.

Follow Prologis Inc. (NYSE:PLD)

Follow Prologis Inc. (NYSE:PLD)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Aleksandr Bagri/Shutterstock.com

How are hedge funds trading Prologis Inc (NYSE:PLD)?

Heading into the fourth quarter of 2016, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a drop of 26% from the previous quarter. On the other hand, there were a total of 14 hedge funds with a bullish position in PLD at the beginning of this year, so hedge fund ownership of the stock is still up in 2016 despite the Q3 drop. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Jeffrey Furber’s AEW Capital Management has the number one position in Prologis Inc (NYSE:PLD), worth close to $330.9 million, comprising 6.9% of its total 13F portfolio. On AEW Capital Management’s heels is Citadel Investment Group, led by Ken Griffin, which holds a $50.3 million position. Remaining members of the smart money that hold long positions consist of Cliff Asness’ AQR Capital Management, Renaissance Technologies, one of the largest hedge funds in the world, and Phill Gross and Robert Atchinson’s Adage Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Prologis Inc (NYSE:PLD) has witnessed falling interest from the aggregate hedge fund industry, logic holds that there was a specific group of hedgies that elected to cut their full holdings by the end of the third quarter. Interestingly, Israel Englander’s Millennium Management dropped the biggest stake of all the hedgies studied by Insider Monkey, valued at about $50.1 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also dropped its stock, about $18.7 million worth.

Let’s now review hedge fund activity in other stocks similar to Prologis Inc (NYSE:PLD). These stocks are V.F. Corporation (NYSE:VFC), PPL Corporation (NYSE:PPL), Deere & Company (NYSE:DE), and Cardinal Health, Inc. (NYSE:CAH). This group of stocks’ market values are similar to PLD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VFC | 22 | 375429 | -1 |

| PPL | 22 | 536205 | -4 |

| DE | 27 | 3324122 | -6 |

| CAH | 26 | 666390 | -8 |

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $1.23 billion. That figure was $594 million in PLD’s case. Deere & Company (NYSE:DE) is the most popular stock in this table. On the other hand V.F. Corporation (NYSE:VFC) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Prologis Inc (NYSE:PLD) is even less popular than VFC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock.

Disclosure: None