Paychex, Inc. (NASDAQ:PAYX) is one of the leading payroll processors in the U.S., and in fact several of my previous employers used the company’s services. What I was surprised to find was that Paychex meets all of my criteria for what a long-term investment needs to have. In addition to its long-range merits, I believe there is also some short-term growth to be had, as the success of the company is very closely correlated with the U.S. job market, which I feel has several years of growth ahead, if not more. This under-the-radar stock could possibly be one of the best investments out there.

About Paychex

Serving over 567,000 clients, Paychex, Inc. (NASDAQ:PAYX) is one of the largest providers of payroll processing, human resource, and benefit services in the United States. Paychex operates in two main segments, payroll and human resources/professional employer organization (HRS/PEO). Payroll does the preparation of clients’ payroll checks, earnings statements, accounting records, as well as tax returns. The HRS/PEO segment provides HR services, as well as management of employee benefit programs.

Most of Paychex’s clients are companies with fewer than 100 employees. Their biggest competitor, Automatic Data Processing (NASDAQ:ADP), handles companies of all sizes. While some see this as a negative, I view Paychex’s small business specialization as a plus for two reasons. They are well-known as the payroll processor of choice for small businesses, and as the economy improves, small businesses tend to grow at an increased rate, which is very good for Paychex.

Growth

As mentioned before, Paychex, Inc. (NASDAQ:PAYX)’s business is very closely tied to the overall health of the economy and job market. One less obvious thing to consider is the correlation between the company’s profits and the current interest rates. When Paychex processes payroll and other items for their clients, they withhold money, such as taxes, which are not handed over to the proper agency immediately. They also hold reserves in their client’s accounts before the money is paid to employees.

Well, all of this money sitting in Paychex’s accounts earns interest. Now, it is no secret that right now the amount of interest money earns in savings is at an all-time low. However, when interest rates finally do rise, this could unlock an entirely new revenue stream for Paychex and its shareholders.

Other areas of growth include Paychex’s focus on expanding its human resources and benefits services, which the company could profit from more than payroll outsourcing alone.

Dividends and A Great Balance Sheet

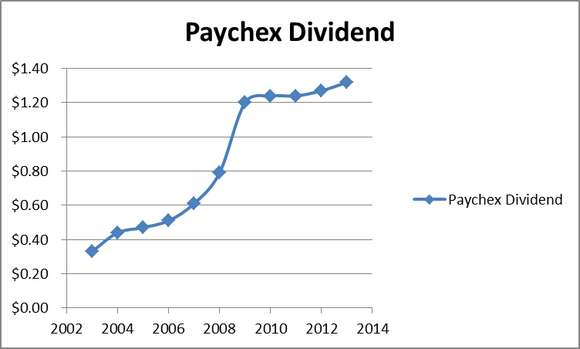

Paychex, Inc. (NASDAQ:PAYX) not only has a debt free balance sheet with over $300 million in cash, but they have also increased their free cash flow by an average of 12% annually for the past five years, and analysts expect a 10% forward growth rate as well. As a result of this growth, Paychex has been able to increase its dividend every single year over the past decade, and currently offers a yield of just under 4% annually.

Valuation and Competition

Given the company’s potential for growth with an improving job market, and later down the road, with increased interest rates, the current valuation of 22 times earnings seems reasonable, especially with the high dividend yield and great balance sheet.

As mentioned earlier, Automatic Data Processing (NASDAQ:ADP) is the market leader in payroll processing, and they operate all over the world. They have a similar number of business clients as Paychex (570,000), but they serve larger businesses, on average. In addition, they have a thriving “dealer services” segment, which provides transaction systems and professional services to automotive and truck dealers all over the world.

I don’t view ADP as too much of a threat, as the market for payroll outsourcing is relatively untapped in the small business market, and there should be plenty of opportunities for both of these companies to grow over the coming years.