Netflix, Inc. (NASDAQ:NFLX) is one of the leading names in the TV streaming industry, along with other players including retail giant Amazon.com, Inc. (NASDAQ:AMZN). Not only is Netflix, Inc. (NASDAQ:NFLX) making headlines with the latest shows like “House of Cards,” it has also made some headlines in the stock market with relatively mixed opinions. The internet streaming industry is huge; however, only one player is likely to dominate the market in the coming years. Netflix currently leads the market with its massive consumer base, while Amazon finds itself growing and expanding at a very fast rate.

Valuation

With a market capital of over $10 billion, Netflix, Inc. (NASDAQ:NFLX) is currently trading between $180 to $190. The stock has seen a whopping 200% growth compared to last year’s $60 valuation in November. The company’s stock rose nearly 50% in January after it reported Q4 earnings, where a net income of $8 million surpassed Wall Street estimates.

(Source:Yahoo! Finance)

Even though Netflix, Inc. (NASDAQ:NFLX) was able to perform well, in terms of profitability, compared to what analysts were predicting, its revenue declined significantly, mainly due to the decline of its DVD division. The company’s sky high P/E ratio might lead to people believing that its an overvalued stock; however, the company has a massive growth opportunity, and some investors would think that taking a risk is worth it, if the stock can rise in similar fashion.

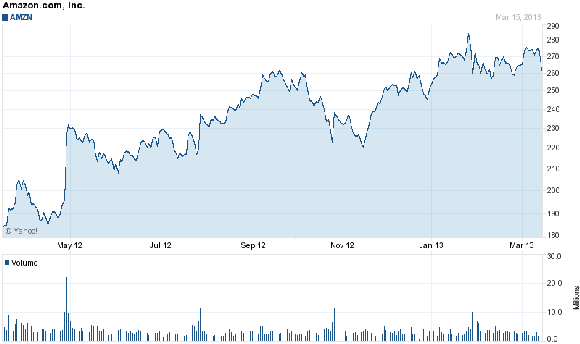

Amazon, on the other hand, is currently trading between $260 and $275.

(Source: Yahoo! Finance)

The retail giant’s valuation is primarily based upon its various other divisions, with Prime streaming being a relatively small division with great potential. Amazon’s stock, after their last earnings report, hasn’t been able to grow well, mainly because the company recorded losses for the quarter. The company might not be a good short term investment, but it promises to be a wonderful investment for patient long-term investors. Jeff Bezos, Amazon’s CEO, recently said that the company is investing in long term projects that will show significant revenue and profit growth in the future. Investment for the long-term means that the company won’t be able to show profits in upcoming quarters.

Netflix: The Good

Netflix has very decent growth potential, and I won’t be surprised if the stock hits the $300 mark again. Some analysts are claiming that Netflix’s good days are behind the company and that upcoming years will see a decline. However, the company’s brand name is so huge that I just don’t see it happening.

Netflix, in economic terms, has the first player advantage. Economic theory suggests that the first player has a chance to dictate the market; which is what Netflix, Inc. (NASDAQ:NFLX) has done. It has captured most of the market with a huge customer base. Also, Netflix has managed to release a lot of different titles for its streaming service. The reason why Amazon might not be a true competitor–it may not be able to get a big enough share of the market due to Netflix’s extensive video library.

The recent Facebook Inc (NASDAQ:FB) deal is seen as another crucial point for Netflix’s future success. The company recently announced that it had entered into the social media space by integrating its streaming service with Facebook. The latest integration means that Netflix subscribers will be able to share content with others, view what their friend’s like and get a “social networking” experience while using the streaming service. Reed Hastings, Netflix’s CEO, believes that the Facebook integration is a crucial factor in Netflix’s future growth as the company plans to grow its brand name even further.