Netflix, Inc. (NASDAQ:NFLX) is one of the leading names in the TV streaming industry, along with other players including retail giant Amazon.com, Inc. (NASDAQ:AMZN). Not only is Netflix, Inc. (NASDAQ:NFLX) making headlines with the latest shows like “House of Cards,” it has also made some headlines in the stock market with relatively mixed opinions. The internet streaming industry is huge; however, only one player is likely to dominate the market in the coming years. Netflix currently leads the market with its massive consumer base, while Amazon finds itself growing and expanding at a very fast rate.

Valuation

With a market capital of over $10 billion, Netflix, Inc. (NASDAQ:NFLX) is currently trading between $180 to $190. The stock has seen a whopping 200% growth compared to last year’s $60 valuation in November. The company’s stock rose nearly 50% in January after it reported Q4 earnings, where a net income of $8 million surpassed Wall Street estimates.

(Source:Yahoo! Finance)

Even though Netflix, Inc. (NASDAQ:NFLX) was able to perform well, in terms of profitability, compared to what analysts were predicting, its revenue declined significantly, mainly due to the decline of its DVD division. The company’s sky high P/E ratio might lead to people believing that its an overvalued stock; however, the company has a massive growth opportunity, and some investors would think that taking a risk is worth it, if the stock can rise in similar fashion.

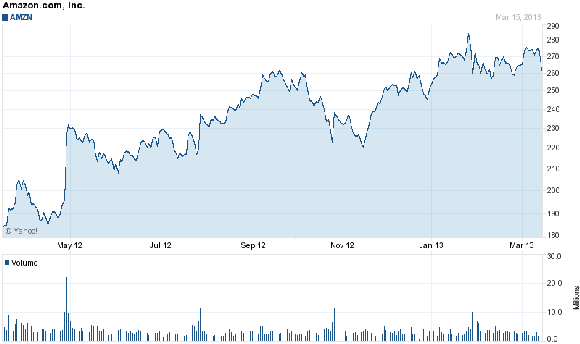

Amazon, on the other hand, is currently trading between $260 and $275.

(Source: Yahoo! Finance)

The retail giant’s valuation is primarily based upon its various other divisions, with Prime streaming being a relatively small division with great potential. Amazon’s stock, after their last earnings report, hasn’t been able to grow well, mainly because the company recorded losses for the quarter. The company might not be a good short term investment, but it promises to be a wonderful investment for patient long-term investors. Jeff Bezos, Amazon’s CEO, recently said that the company is investing in long term projects that will show significant revenue and profit growth in the future. Investment for the long-term means that the company won’t be able to show profits in upcoming quarters.

Netflix: The Good

Netflix has very decent growth potential, and I won’t be surprised if the stock hits the $300 mark again. Some analysts are claiming that Netflix’s good days are behind the company and that upcoming years will see a decline. However, the company’s brand name is so huge that I just don’t see it happening.

Netflix, in economic terms, has the first player advantage. Economic theory suggests that the first player has a chance to dictate the market; which is what Netflix, Inc. (NASDAQ:NFLX) has done. It has captured most of the market with a huge customer base. Also, Netflix has managed to release a lot of different titles for its streaming service. The reason why Amazon might not be a true competitor–it may not be able to get a big enough share of the market due to Netflix’s extensive video library.

The recent Facebook Inc (NASDAQ:FB) deal is seen as another crucial point for Netflix’s future success. The company recently announced that it had entered into the social media space by integrating its streaming service with Facebook. The latest integration means that Netflix subscribers will be able to share content with others, view what their friend’s like and get a “social networking” experience while using the streaming service. Reed Hastings, Netflix’s CEO, believes that the Facebook integration is a crucial factor in Netflix’s future growth as the company plans to grow its brand name even further.

This integration was planned in 2011; however, the company couldn’t go forward with the plan. 2013 is probably the best year for the company to integrate with Facebook as it plans to release several more titles later this year. The Facebook deal will obviously not push up the stock price; however, its a good long-term opportunity to make the brand even bigger.

Netflix’s investment into foreign markets is another thing to be optimistic about. The company has invested heavily in the European markets and continues to push their brand name and services in international markets as more and more people around the world are adapting to the Internet TV trend.

If Netflix, Inc. (NASDAQ:NFLX) continues to invest in its original content and deals with various studios, then the subscriber count will definitely increase. Investing in these areas might mean a cash outflow in the short run, but an increase in overall revenue in the long run.

Netflix: The Bad

One of the reasons why some analysts don’t see Netflix growing in the future is Amazon’s entry into the market. Amazon is a far bigger brand name than Netflix, as it has a popular e-commerce division, along with a massive library of books. Even though Netflix has the most subscribers, Amazon is slowly getting there–it reached the 10 million mark last year.

If Amazon can take the right decisions, it can literally destroy Netflix. The company has already invested in original content creation and has an extensive library for its readers. The integration opportunities for Amazon are numerous, as they have several different divisions. Integrating its streaming service with other divisions like the Amazon Kindle and its library of books are just two such opportunities for the company. Not only will this improve the Amazon Prime service, but this will also improve the performance of other divisions. What Netflix has done with Facebook, Amazon can do several times within its own company.

The decline of Netflix’s DVD segment is another thing to be worried about. Hastings admitted that the DVD division will continue to decline forever and that the company moved too fast. He also stated that the profitability of the streaming service is twice than the DVD segment and that the company tried to satisfy both types of customers. Netflix needs to either grow its streaming service in the international markets or it needs to invest in something new in order to counter the decline of its DVD division.

Conclusion

Netflix, Inc. (NASDAQ:NFLX) remains a decent company with great growth potential for the future. It already pleased some of its investors when the stock grew over 200%. The Internet TV industry is going nowhere as more and more people from different countries are adapting this latest trend. RedBox and other relatively new streaming services have also entered into the industry. The growth of Internet TV, along with Netflix’s huge consumer base, offers a lot to be optimistic about. However, the risk factor involved is mainly due to competition as Amazon tries to put Netflix out of business. Amazon’s global brand recognition and its future strategies will definitely impact Netflix in one way or another. Netflix remains a very interesting stock with very high capital gain potential, but at the cost of severe risk, which I believe is worth taking.

The article Netflix: A Stock Worth The Risk originally appeared on Fool.com and is written by Yasir Idrees.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.