Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

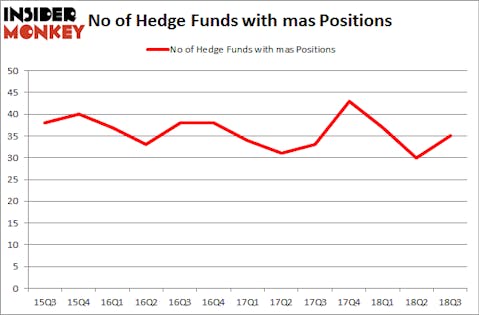

Is Masco Corporation (NYSE:MAS) a buy here? The smart money is getting more bullish. The number of long hedge fund bets advanced by 5 recently. Our calculations also showed that mas isn’t among the 30 most popular stocks among hedge funds. MAS was in 35 hedge funds’ portfolios at the end of the third quarter of 2018. There were 30 hedge funds in our database with MAS positions at the end of the previous quarter.

To the average investor there are many gauges shareholders have at their disposal to appraise publicly traded companies. Two of the less utilized gauges are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the best money managers can outperform their index-focused peers by a very impressive margin (see the details here).

We’re going to review the fresh hedge fund action surrounding Masco Corporation (NYSE:MAS).

How are hedge funds trading Masco Corporation (NYSE:MAS)?

At the end of the third quarter, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 17% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MAS over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Citadel Investment Group was the largest shareholder of Masco Corporation (NYSE:MAS), with a stake worth $222.8 million reported as of the end of September. Trailing Citadel Investment Group was Iridian Asset Management, which amassed a stake valued at $179.4 million. Two Sigma Advisors, Alyeska Investment Group, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key money managers were leading the bulls’ herd. Nokota Management, managed by Matthew Knauer and Mina Faltas, created the most valuable call position in Masco Corporation (NYSE:MAS). Nokota Management had $9.2 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $9.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Matthew Tewksbury’s Stevens Capital Management, Clint Carlson’s Carlson Capital, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Masco Corporation (NYSE:MAS) but similarly valued. We will take a look at Canopy Growth Corporation (NYSE:CGC), Ally Financial Inc (NYSE:ALLY), Ralph Lauren Corporation (NYSE:RL), and Hologic, Inc. (NASDAQ:HOLX). This group of stocks’ market valuations are closest to MAS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CGC | 16 | 113854 | 9 |

| ALLY | 40 | 2200238 | -6 |

| RL | 28 | 990094 | 3 |

| HOLX | 22 | 686964 | -2 |

| Average | 26.5 | 997788 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.5 hedge funds with bullish positions and the average amount invested in these stocks was $998 million. That figure was $1.07 billion in MAS’s case. Ally Financial Inc (NYSE:ALLY) is the most popular stock in this table. On the other hand Canopy Growth Corporation (NYSE:CGC) is the least popular one with only 16 bullish hedge fund positions. Masco Corporation (NYSE:MAS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ALLY might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.