Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have been underperforming the large-cap indices. However, things have dramatically changed over the last 5 months. Small-cap stocks reversed their misfortune and beat the large cap indices by almost 11 percentage points since the end of June. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of WABCO Holdings Inc. (NYSE:WBC).

WABCO Holdings Inc. (NYSE:WBC) investors should be aware of a decrease in hedge fund sentiment recently. At the end of this article we will also compare WBC to other stocks including Casey’s General Stores, Inc. (NASDAQ:CASY), The Hain Celestial Group, Inc. (NASDAQ:HAIN), and Highwoods Properties Inc (NYSE:HIW) to get a better sense of its popularity.

Follow Wabco Holdings Inc. (NYSE:WBC)

Follow Wabco Holdings Inc. (NYSE:WBC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Sergey Nivens/Shutterstock.com

With all of this in mind, we’re going to review the new action surrounding WABCO Holdings Inc. (NYSE:WBC).

What does the smart money think about WABCO Holdings Inc. (NYSE:WBC)?

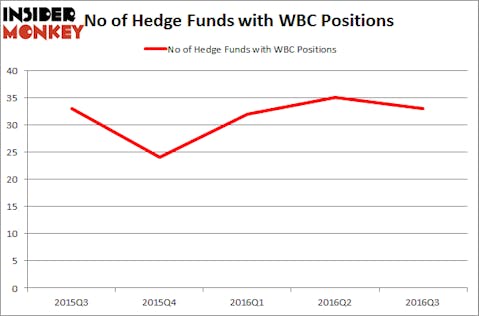

Heading into the fourth quarter of 2016, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 6% from the previous quarter. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Berkshire Hathaway, managed by Warren Buffett, holds the number one position in WABCO Holdings Inc. (NYSE:WBC). The fund has a $382.4 million position in the stock, comprising 0.3% of its 13F portfolio. The second largest stake is held by FPR Partners, managed by Bob Peck and Andy Raab, which holds a $332 million position; the fund has 7.5% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions consist of Lou Simpson’s SQ Advisors, Sharlyn C. Heslam’s Stockbridge Partners and John Smith Clark’s Southpoint Capital Advisors.

Since WABCO Holdings Inc. (NYSE:WBC) has witnessed a decline in interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of hedgies that slashed their entire stakes last quarter. It’s worth mentioning that Steve Cohen’s Point72 Asset Management sold off the biggest position of the 700 funds monitored by Insider Monkey, worth an estimated $26.6 million in stock. Louis Bacon’s fund, Moore Global Investments, also dropped its stock, about $20.1 million worth of WBC shares. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to WABCO Holdings Inc. (NYSE:WBC). These stocks are Casey’s General Stores, Inc. (NASDAQ:CASY), The Hain Celestial Group, Inc. (NASDAQ:HAIN), Highwoods Properties Inc (NYSE:HIW), and Zions Bancorporation (NASDAQ:ZION). This group of stocks’ market valuations match WBC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CASY | 22 | 448259 | -6 |

| HAIN | 32 | 388383 | 9 |

| HIW | 5 | 94726 | -5 |

| ZION | 39 | 471895 | -1 |

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $351 million. That figure was an impressive $1.44 billion in WBC’s case. Zions Bancorporation (NASDAQ:ZION) is the most popular stock in this table. On the other hand Highwoods Properties Inc (NYSE:HIW) is the least popular one with only 5 bullish hedge fund positions. WABCO Holdings Inc. (NYSE:WBC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ZION might be a better candidate to consider a long position.

Suggested Articles:

Countries With The Best Healthcare

Easiest Decades To Dress Up As

Fastest Growing Cities In India

Disclosure: none.