Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX).

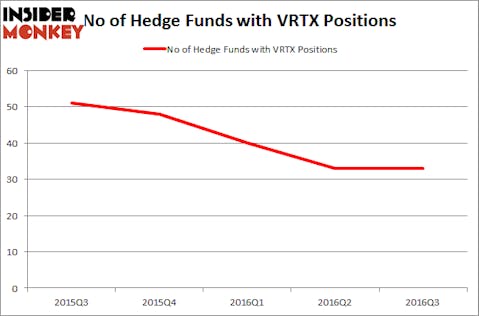

Hedge fund interest in Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Edwards Lifesciences Corp (NYSE:EW), Synchrony Financial (NYSE:SYF), and Apache Corporation (NYSE:APA) to gather more data points.

Follow Vertex Pharmaceuticals Inc / Ma (NASDAQ:VRTX)

Follow Vertex Pharmaceuticals Inc / Ma (NASDAQ:VRTX)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Pressmaster/Shutterstock.com

Now, we’re going to take a look at the fresh action regarding Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX).

What have hedge funds been doing with Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX)?

Heading into the fourth quarter of 2016, a total of 33 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from one quarter earlier. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, OrbiMed Advisors, managed by Samuel Isaly, holds the most valuable position in Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX). According to regulatory filings, the fund has a $140.6 million position in the stock, comprising 1.6% of its 13F portfolio. Coming in second is Phill Gross and Robert Atchinson of Adage Capital Management, with a $50.2 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining professional money managers with similar optimism encompass Joshua Friedman and Mitchell Julis’s Canyon Capital Advisors, D. E. Shaw’s D E Shaw and Israel Englander’s Millennium Management.