We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in Q3, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards US Foods Holding Corp (NYSE:USFD).

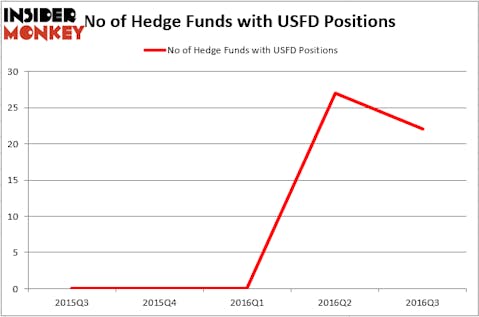

US Foods Holding Corp (NYSE:USFD) was included in the 13F portfolios of 22 funds from our database at the end of September. The company registered a decline in popularity during the third quarter, as there had been 27 funds with long positions at the end of June. At the end of this article we will also compare USFD to other stocks including W.R. Grace & Co. (NYSE:GRA), WellCare Health Plans, Inc. (NYSE:WCG), and PacWest Bancorp (NASDAQ:PACW) to get a better sense of its popularity.

Follow Us Foods Holding Corp. (NYSE:USFD)

Follow Us Foods Holding Corp. (NYSE:USFD)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wrangler/Shutterstock.com

Keeping this in mind, let’s take a peek at the latest action regarding US Foods Holding Corp (NYSE:USFD).

How are hedge funds trading US Foods Holding Corp (NYSE:USFD)?

At the end of the third quarter, a total of 22 funds tracked by Insider Monkey were bullish on this stock, down by 19% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards USFD over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ricky Sandler’s Eminence Capital has the largest position in US Foods Holding Corp (NYSE:USFD), worth close to $128.7 million, comprising 2.1% of its total 13F portfolio. Coming in second is Citadel Investment Group, led by Ken Griffin, which holds a $108.6 million position; 0.1% of its 13F portfolio is allocated to the stock. Other members of the smart money that hold long positions contain Dmitry Balyasny’s Balyasny Asset Management, Anand Parekh’s Alyeska Investment Group and Millennium Management, one of the biggest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.