Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Time Warner Inc (NYSE:TWX), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

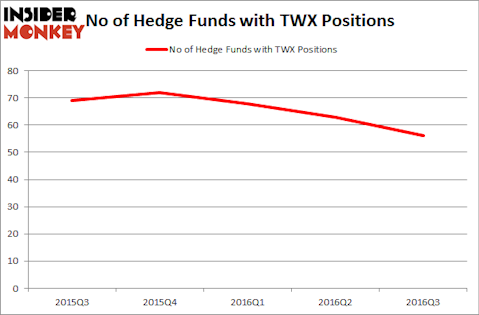

Is Time Warner Inc (NYSE:TWX) the right pick for your portfolio? Money managers are getting less optimistic. During the third quarter, the number of funds holding shares of the company slid by seven. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as American Express Company (NYSE:AXP), Abbott Laboratories (NYSE:ABT), and Occidental Petroleum Corporation (NYSE:OXY) to gather more data points.

Follow Warner Media Llc (NYSE:TWX)

Follow Warner Media Llc (NYSE:TWX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

alexwhite/Shutterstock.com

Now, we’re going to take a look at the recent action surrounding Time Warner Inc (NYSE:TWX).

What have hedge funds been doing with Time Warner Inc (NYSE:TWX)?

At the end of the third quarter, a total of 56 of the hedge funds tracked by Insider Monkey were long this stock, down by 11% from the second quarter of 2016. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Citadel Investment Group, managed by Ken Griffin, holds the largest position in Time Warner Inc (NYSE:TWX). Citadel Investment Group has a $308.8 million position in the stock, comprising 0.3% of its 13F portfolio. Sitting at the No. 2 spot is Greenlight Capital, managed by David Einhorn, which holds a $307.6 million position; the fund has 5.9% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions comprise Daniel S. Och’s OZ Management, Philippe Laffont’s Coatue Management and D. E. Shaw’s D E Shaw.

Seeing as Time Warner Inc (NYSE:TWX) has faced declining sentiment from hedge fund managers, it’s safe to say that there was a specific group of hedgies who sold off their full holdings between July and September. It’s worth mentioning that Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the biggest stake of the 700 funds watched by Insider Monkey, worth an estimated $96.3 million in stock. James Crichton’s fund, Hitchwood Capital Management, also cut its stock, about $73.5 million worth.

Let’s go over hedge fund activity in other stocks similar to Time Warner Inc (NYSE:TWX). These stocks are American Express Company (NYSE:AXP), Abbott Laboratories (NYSE:ABT), Occidental Petroleum Corporation (NYSE:OXY), and Rio Tinto plc (ADR) (NYSE:RIO). All of these stocks’ market caps match TWX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AXP | 49 | 12341242 | 1 |

| ABT | 52 | 1816762 | 5 |

| OXY | 40 | 1044119 | 2 |

| RIO | 18 | 394224 | -3 |

As you can see these stocks had an average of 40 hedge funds with bullish positions and the average amount invested in these stocks was $3.90 billion. That figure was $3.32 billion in Time Warner’s case. Abbott Laboratories (NYSE:ABT) is the most popular stock in this table. On the other hand Rio Tinto plc (ADR) (NYSE:RIO) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Time Warner Inc (NYSE:TWX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.