World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

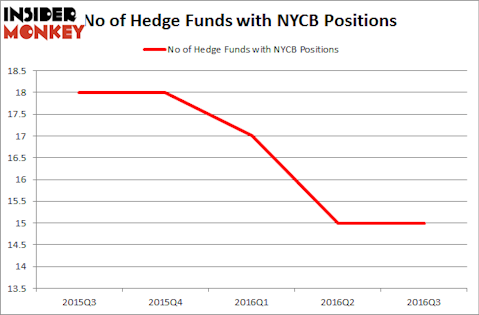

In this article, we’ll discuss the hedge fund sentiment towards New York Community Bancorp, Inc. (NYSE:NYCB). Overall, among the funds we track at Insider Monkey, the number of investors long NYCB remained flat during the third quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Icahn Enterprises LP (NASDAQ:IEP), W.P. Carey Inc. REIT (NYSE:WPC), and Seagate Technology PLC (NASDAQ:STX) to gather more data points.

Follow Flagstar Bank National Association (NYSE:NYSE:FLG)

Follow Flagstar Bank National Association (NYSE:NYSE:FLG)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Fer Gregory/Shutterstock.com

Now, we’re going to go over the latest action surrounding New York Community Bancorp, Inc. (NYSE:NYCB).

What does the smart money think about New York Community Bancorp, Inc. (NYSE:NYCB)?

At the end of September, 15 of the hedge funds tracked by Insider Monkey were bullish on NYCB, unchanged over the quarter. Below, you can check out the change in hedge fund sentiment towards NYCB over the last five quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jim Simons’ Renaissance Technologies has the number one position in New York Community Bancorp, Inc. (NYSE:NYCB), worth close to $124.6 million, corresponding to 0.2% of its total 13F portfolio. On Renaissance Technologies’s heels is Kahn Brothers holding a $32.1 million position; the fund has 5.8% of its 13F portfolio invested in the stock. Other peers that hold long positions comprise Israel Englander’s Millennium Management, John Overdeck and David Siegel’s Two Sigma Advisors, and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that said goodbye to their entire stakes in the stock during the third quarter. Intriguingly, Anton Schutz’s Mendon Capital Advisors said goodbye to the biggest position of all the hedgies tracked by Insider Monkey, totaling an estimated $12.7 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dropped its call options, about $0.7 million worth.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as New York Community Bancorp, Inc. (NYSE:NYCB) but similarly valued. We will take a look at Icahn Enterprises LP (NASDAQ:IEP), W.P. Carey Inc. REIT (NYSE:WPC), Seagate Technology PLC (NASDAQ:STX), and AngloGold Ashanti Limited (ADR) (NYSE:AU). This group of stocks’ market valuations resemble NYCB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IEP | 4 | 6591251 | -2 |

| WPC | 16 | 133759 | 5 |

| STX | 33 | 1215628 | 10 |

| AU | 21 | 520074 | -6 |

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $2.12 billion, although this value is mainly due to Carl Icahn’s $6.42 billion stake in Icahn Enterprises. By comparison, the 15 funds from our database amassed $201 million worth of NYCB stock at the end of September. Seagate Technology PLC (NASDAQ:STX) is the most popular stock in this table. On the other hand Icahn Enterprises LP (NASDAQ:IEP) is the least popular one with only four bullish hedge fund positions. New York Community Bancorp, Inc. (NYSE:NYCB) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Seagate Technology PLC (NASDAQ:STX) might be a better candidate to consider taking a long position in.

Suggested Articles:

Jobs That Will Always Be In Demand

Most Famous Artifacts From The Ancient World

Easiest Drones To Fly With A Camera

Disclosure: None