Reputable billionaire investors such as Nelson Peltz and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

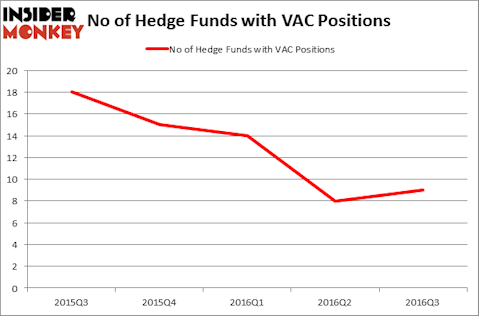

Marriott Vacations Worldwide Corp (NYSE:VAC) shareholders have witnessed an increase in hedge fund interest of late. There were 8 hedge funds in our database with VAC holdings at the end of the previous quarter. At the end of this article we will also compare VAC to other stocks including Planet Fitness Inc (NYSE:PLNT), Monro Muffler Brake Inc (NASDAQ:MNRO), and Golar LNG Limited (USA) (NASDAQ:GLNG) to get a better sense of its popularity.

Follow Marriott Vacations Worldwide Corp (NYSE:VAC)

Follow Marriott Vacations Worldwide Corp (NYSE:VAC)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Air Images/Shutterstock.com

What have hedge funds been doing with Marriott Vacations Worldwide Corp (NYSE:VAC)?

At Q3’s end, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a gain of 13% from the second quarter of 2016. On the other hand, there were a total of 15 hedge funds with a bullish position in VAC at the beginning of this year. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Steven Richman’s East Side Capital (RR Partners) has the biggest position in Marriott Vacations Worldwide Corp (NYSE:VAC), worth close to $45.4 million, accounting for 2.2% of its total 13F portfolio. Sitting at the No. 2 spot is Balyasny Asset Management, led by Dmitry Balyasny, which holds a $3.8 million position. Some other peers with similar optimism include D E Shaw, one of the biggest hedge funds in the world, Cliff Asness’ AQR Capital Management and Matthew Hulsizer’s PEAK6 Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, specific money managers have been driving this bullishness. Balyasny Asset Management initiated the most outsized position in Marriott Vacations Worldwide Corp (NYSE:VAC). Andrew Weiss’ Weiss Asset Management also made a $0.2 million investment in the stock during the quarter. The other funds with brand new VAC positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks similar to Marriott Vacations Worldwide Corp (NYSE:VAC). These stocks are Planet Fitness Inc (NYSE:PLNT), Monro Muffler Brake Inc (NASDAQ:MNRO), Golar LNG Limited (USA) (NASDAQ:GLNG), and Parkway Properties Inc (NYSE:PKY). This group of stocks’ market valuations resemble VAC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLNT | 18 | 92505 | 2 |

| MNRO | 13 | 216304 | 0 |

| GLNG | 25 | 401523 | 5 |

| PKY | 11 | 67753 | -2 |

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $195 million. That figure was $55 million in VAC’s case. Golar LNG Limited (USA) (NASDAQ:GLNG) is the most popular stock in this table. On the other hand Parkway Properties Inc (NYSE:PKY) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Marriott Vacations Worldwide Corp (NYSE:VAC) is even less popular than PKY. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None