At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

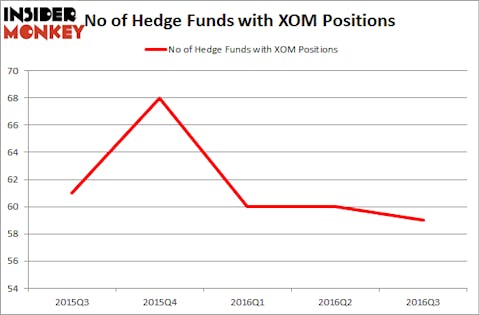

Is Exxon Mobil Corporation (NYSE:XOM) going to take off soon? The smart money is getting less optimistic. The funds holding shares of the company inched down by one during the third quarter. To get a better sense of its popularity, we will also compare XOM to other stocks including Berkshire Hathaway Inc. (NYSE:BRK-B), Amazon.com, Inc. (NASDAQ:AMZN), and Johnson & Johnson (NYSE:JNJ) at the end of this article.

Follow Exxon Mobil Corp (NYSE:XOM)

Follow Exxon Mobil Corp (NYSE:XOM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

maradon 333/Shutterstock.com

Now, we’re going to take a gander at the recent action encompassing Exxon Mobil Corporation (NYSE:XOM).

What have hedge funds been doing with Exxon Mobil Corporation (NYSE:XOM)?

Heading into the fourth quarter of 2016, a total of 59 funds tracked by Insider Monkey were bullish on this stock, down by 2% from one quarter earlier. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ken Fisher’s Fisher Asset Management has the most valuable position in Exxon Mobil Corporation (NYSE:XOM), worth close to $402.5 million, corresponding to 0.7% of its total 13F portfolio. On Fisher Asset Management’s heels is AQR Capital Management, led by Cliff Asness, holding a $371.7 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions include Richard S. Pzena’s Pzena Investment Management, Donald Yacktman’s Yacktman Asset Management and Daniel S. Och’s OZ Management.

Seeing as Exxon Mobil Corporation (NYSE:XOM) has witnessed declining sentiment from the aggregate hedge fund industry, logic holds that there lies a certain “tier” of money managers that elected to cut their entire stakes during the third quarter. Intriguingly, Ken Griffin’s Citadel Investment Group said goodbye to the biggest position of the 700 funds monitored by Insider Monkey, worth about $317.8 million in call options., and Eric W. Mandelblatt’s Soroban Capital Partners was right behind this move, as the fund said goodbye to about $131.2 million worth.

Let’s also examine hedge fund activity in other stocks similar to Exxon Mobil Corporation (NYSE:XOM). We will take a look at Berkshire Hathaway Inc. (NYSE:BRK-B), Amazon.com, Inc. (NASDAQ:AMZN), Johnson & Johnson (NYSE:JNJ), and Facebook Inc (NASDAQ:FB). This group of stocks’ market values resemble XOM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BRK-B | 74 | 20315727 | -4 |

| AMZN | 150 | 20794328 | 5 |

| JNJ | 82 | 5146011 | 0 |

| FB | 149 | 16275572 | 1 |

As you can see these stocks had an average of 114 hedge funds with bullish positions and the average amount invested in these stocks was $15.63 billion. That figure was $2.83 billion in XOM’s case. Amazon.com, Inc. (NASDAQ:AMZN) is the most popular stock in this table, while Berkshire Hathaway Inc. (NYSE:BRK-B) is the least popular one with only 74 bullish hedge fund positions. Compared to these stocks Exxon Mobil Corporation (NYSE:XOM) is even less popular than BRK-B. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.